Archives of “June 6, 2020” day

rssThe US #yieldcurve has not been this ‘steep’ since February 2018! And that is with a 10-year Treasury #yield still below 1%.

#FederalReserve balance sheet now up to USD 7.2 trillion!

Do you see it Of course you do

“Never bet against the United States.” Warren buffett

Since the March lows, most of the S&P 500 earnings have been generated overnight.

The value of money in the time.

Fed stimuli have worked.

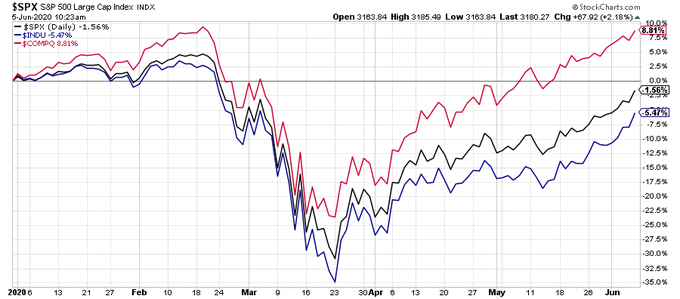

The Dow, the NASDAQ and the S&P 500 year to date.

US Indices close sharply higher. NASDAQ prints a new all-time high

Dow, S&P best week in 2 months

The major US stock indices closed sharply higher after the much better-than-expected employment report.

- The gains propel the NASDAQ index to a new all time high.

- The Dow is now on its longest winning streak since January (5 day win streak).

- The S&P and Dow had their best week in 2 months.

- The S&P is within 1.14% of the closing level from 2019.

- The NASDAQ 100 index close at an all-time record high

A look at the final numbers are showing:

- S&P index rose 81.58 points or 2.62% at 3193.93

- NASDAQ index rose 198.26 points or 2.06% at 9814.08

- Dow industrial average rose 829.16 points or 3.15% at 27110.98.

For the week, rotation into to Dow stocks was the storyline.

- Dow rose by 6.81%

- S&P rose by 4.91%

- Nasdaq rose by 3.42%

For the year to date, the Nasdaq is up over 9%. The other indices are still down on the year but the S&P is getting close to the unchanged level:

- Nasdaq, +9.38%

- S&P, -1.14%

- Dow, -5.0%

Oversized winners today included:

- US steel, +13.73%

- Ford motor, +11.87%

- Boeing, +11.46%

- United Airlines +8.52%

- Exxon Mobil, 8.21%

- Daimler +7.28%

- Raytheon technologies, +6.75%

- Citigroup, +5.71%

- Delta Air Lines, +5.43%