Archives of “June 5, 2020” day

rssTrump admin to issue revised China flight restrictions

The airline spat de-escalates

The US had planned to band Chinese passenger flight from the US because China had blocked US carriers on coronavirus fears. However China has now backed down and the US has revised its plan, according to multiple reports.

That’s more good news for risk sentiment (as if the market needed it).

European equity markets finish the week with gains greater than 10%

Massive week for European stock markets

Closing changes for the main bourses:

- German DAX +3.4%

- UK FTSE 100 +2.2%

- Italy MIB +2.7%

- French CAC +3.5%

- Spain IBEX +4.2%

On the week:

- German DAX +9.1%

- UK FTSE 100 +6.6%

- Italy MIB +10.9%

- French CAC +10.4%

- Spain IBEX +10.9%

When tack on a 2% rally in EUR/USD the gains look even better. With gains like this you can see why money is flowing into the euro.

The run in Italian stocks has been spectacular:

Trump will host a press conference at 10 am ET

Trump to speak about the jobs report

Here’s a preview of what he will say:

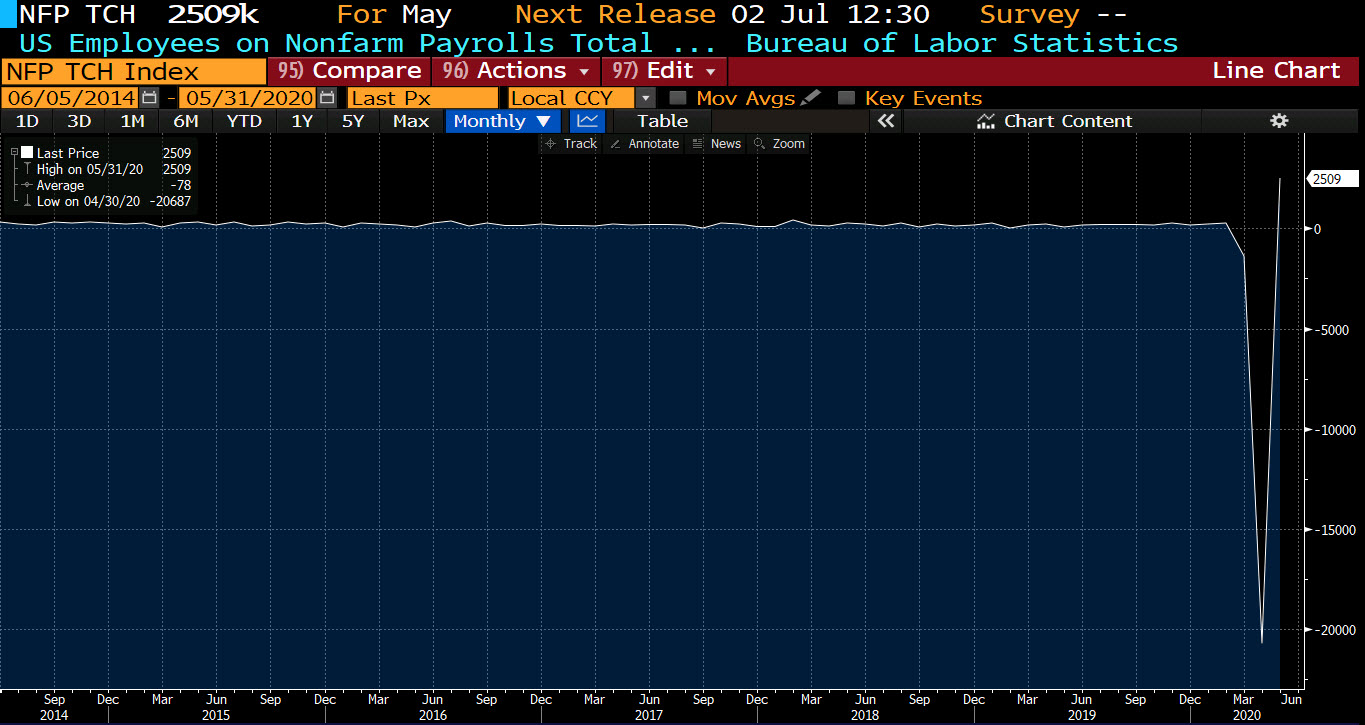

US nonfarm payroll for May rose +2509K vs -7500K estimate

Highlights of the US May employment report

- Change in Nonfarm payroll 2509K vs -7500K estimate. Prior month revised to -20687K vs -20537K estimate

- two month Prior month revised -642K

- Unemployment rate 13.3% vs. 19% estimate. Prior month 14.7%

- Change in private payroll 3094K vs -6750K estimate. Prior month -19724K vs. -19557K

- Change in Manufacturing jobs plus 225K vs. -400K estimate

- Average weekly hours 34.7 vs. 34.3 estimate

- Average hourly earnings MOM -1.0% vs. +1.0 estimate

- Average hourly earnings YoY 6.7% vs. 8.5% estimate

- Participation rate 60.8% vs. 60.1% estimate. Last month 60.2%

- Service sector rose by 2.4 million

- goods producing jobs increase 669K vs -2373K last month

A breakdown of the sectors shows:

- leisure and hospitality showed a gain of 1.239 million vs. -7.539 last month

- retail trade increased by 368K vs -2286K last month

- education, health increase by 424K vs -2590K last month

- business services rose by 127K vs.-2189K last month

- construction jobs rose 464K vs -995K last month

- government jobs fell -585K vs -963K last month

- financial rose 33K va -264K last month

- information-38K vs -272K last month

- Trade, transport +368K vs -3225Klast month

Surprise. Surprise.

Japan’s Suga says that relations with South Korea remain in a severe state

Japan and South Korea are continuing to fight on trade now that the coronavirus crisis is settling down

Old habits die hard and as the coronavirus crisis settles down, trade wars are coming back into focus and the one between Japan and South Korea remains a focal point in the region.

South Korea had earlier in the week sought to reopen a WTO complaint – which they halted back in November – against Japan on trade curbs over technology exports and that is renewing the rift between the two countries over the past few days.

Both sides tried to seek bilateral talks in the meantime but so far there doesn’t appear to be much progress in addressing the matter.

If anything, just take note of this as it will weigh on both countries’ economies.

Another day, another massive rally in European #equities. Euro Stoxx 50 up a whopping 23% since mid May

Bundesbank sees the German economy shrinking by 7.1% this year

Bundesbank releases their latest forecasts on the German economy

- German GDP to grow by 3.2% in 2021, 3.8% in 2020

- Says that projections don’t include the recent fiscal package by the government

Meanwhile, Bundesbank chief Weidmann also gives the thumbs up to the recent government action by saying that the fiscal support has been appropriate and the central bank takes a more positive view on the recent measures.

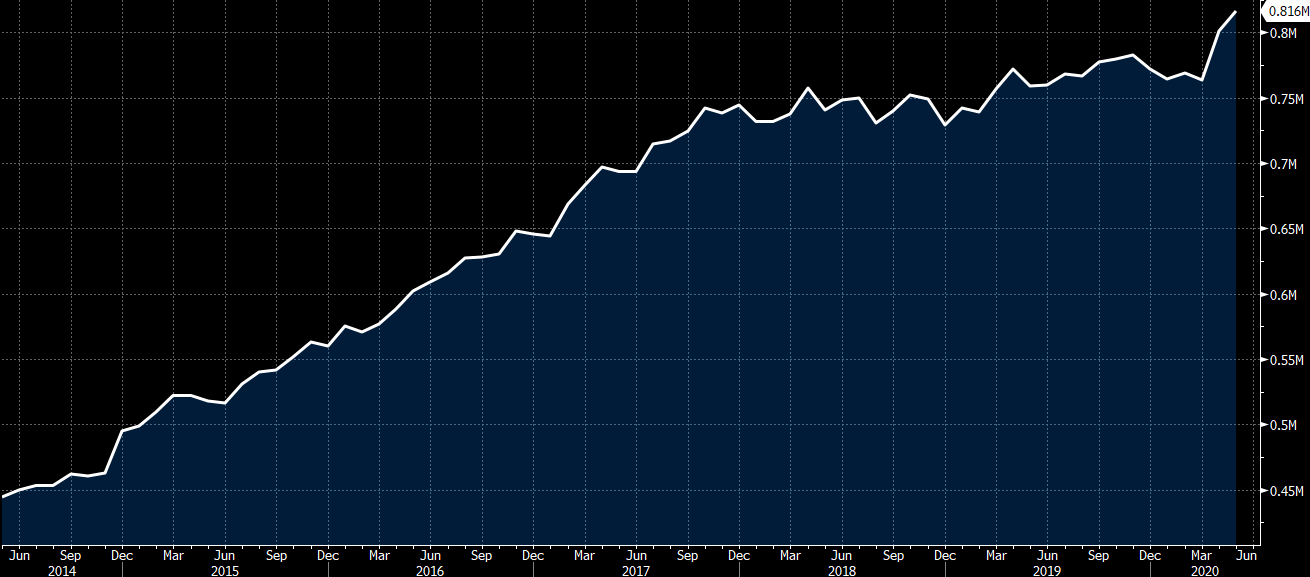

Switzerland May foreign currency reserves CHF 816.3 billion vs CHF 799.9 billion prior

Latest data released by the SNB – 5 June 2020

- Prior CHF 799.9 billion

Slight delay in the release by the source. Another jump in Swiss foreign reserves and alongside sight deposits data, it reaffirms that the SNB is continuing to intervene to limit the appreciation in the franc and they will be happy with the EUR/CHF trajectory over the past week or so – currently seen trading at 1.0858.

ETFs amassed more gold in 5 months than in any previous full year: WGC

Gold-backed exchange traded funds (ETFs) added 623 tonnes of the metal worth $34 billion to their stockpile from January to May, exceeding in five months every full-year increase on record, the World Gold Council said on Thursday.

In May alone, the increase was 154 tonnes, it said.

Many investors think gold is likely to hold or increase its value as the fallout from the coronavirus outbreak devalues other assets.

Gold prices are up 13% this year at around $1,700 an ounce. Though demand from investors has been strong, sales of jewellery and gold bars and coins in Asia have plunged, preventing prices from rising further.

ETFs store gold on investors’ behalf.

The biggest annual increase in ETF holdings is during 2009, during the financial crisis, when they added 591 tonnes, the World Gold Council said.

Its numbers show that by the end of May this year, gold-backed ETFs held 3,510 tonnes of gold worth $195 billion.