Well, for now at least

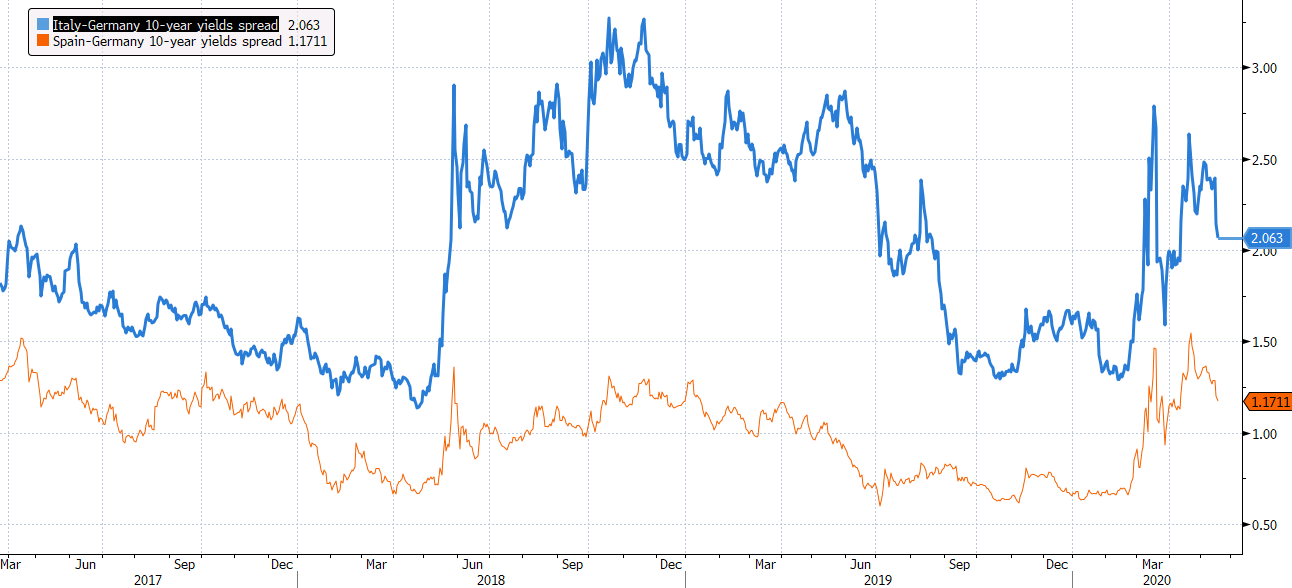

And this will also help to add a tailwind for equities/risk in the near-term as bond investors add to the optimism. The yields spread between 10-year Italian and German bonds has now narrowed to its tightest levels in five weeks to 206 bps.

This comes amid a continued fall in Italian bond yields, with 10-year yields now at 1.62%.

The hope with the recovery fund proposal by Germany and France is that it is something that is put together because it has enough support to get through. But I’m not too sure if that will necessarily be the case as Italy and Spain may need more convincing.

That said, a key change under this latest proposal is that the funds will be given as grants (instead of loans), something which Italy and Spain has been fighting for.