The opening session of the Chinese People’s Political Consultative Conference (CPPCC) was held yesterday.

The National People’s Congress (NPC) gets underway today. Both had been delayed due to the COVID-19 outbreak.

Premier Li Keqiang will hand the government work report to the NPC today, this usually includes economic targets for the year. The target is a keen focus for markets given the impact of the virus. China reported the GDP last year was 6.1%, within the 6 to 6.5% target range set. In addition to the target watch for comments on relations with the US from the Premier. ICYMI these have deteriorated lately!

If time permits later I’ll get an online session of ‘Where’s Waldo?’ running.

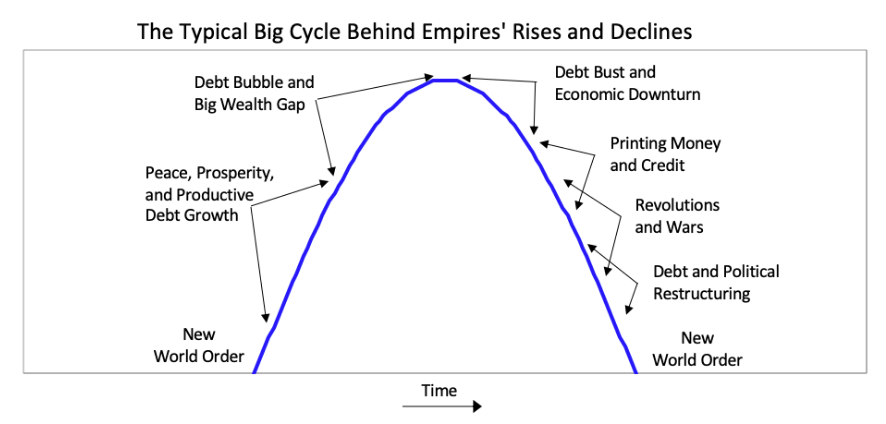

One of the greatest living macro investors continues on his long, plodding journey to lay out his thesis on the decline of America.

One of the greatest living macro investors continues on his long, plodding journey to lay out his thesis on the decline of America.