US President Trump and others in his administration have once again been ramping up anti-China rhetoric.

Which has brought the trade war back into focus. Currently we are at a ‘phase 1’ agreement (of many more to come potentially, phase 1 barely scratched the surface). With Trump’s blaming China, for pretty much anything and everything it seems, it raises the prospect of little progress ahead on trade issues. And with the US election to come in November its likely Trump will continue to aim belligerence at China.

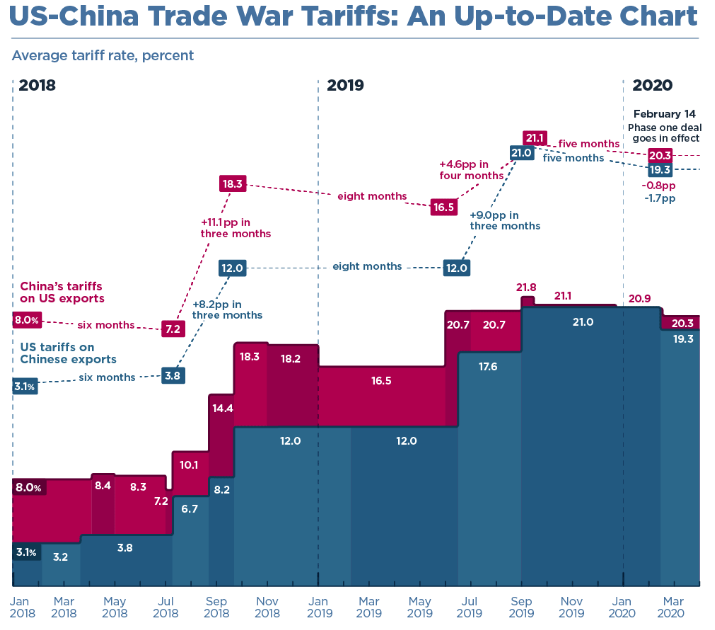

Via the Peterson Institute for International Economics (PIIE) a representation of where tariffs are, in summary:

Keep on eye out for progress, though I do not expect any. Escalation of the trade war is a negative for ‘risk’ (we saw this last week with a drop in, for example, the AUD) as Trump’s bellicose comments gained market attention once again.