I think that is almost certainly the case for everyone in the world right now

- The psychological situation is worse than the Great Depression

- It is not true that cost of Olympics delay has been agreed

- Important for IOC, organizers to cooperate on the extra costs

Even before the coronavirus pandemic, the Japanese economy had been struggling big time and all of the latest developments will just exacerbate those problems.

The BOJ is also starting to run out of creative juice to try and bolster economic confidence and there is a real fear of strong deflation risks the longer this keeps up.

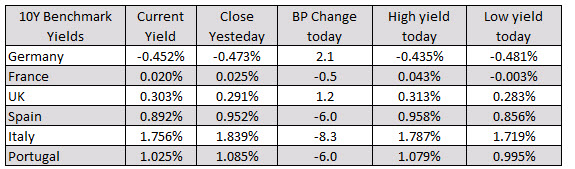

In the European debt market, the the benchmark 10 year yields were mixed with Germany and UK yields up while France, Spain, Italy, and Portugal yields lower.

In the European debt market, the the benchmark 10 year yields were mixed with Germany and UK yields up while France, Spain, Italy, and Portugal yields lower.