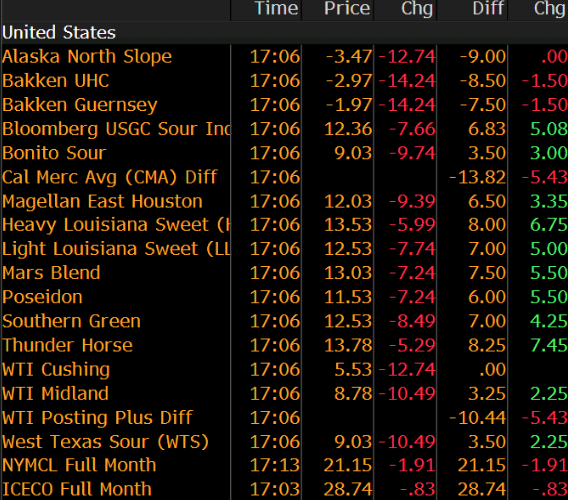

It’s all about the ETFs

It’s all about oil ETFs now.

Retail money was flooding into oil ETFs today — particularly USO — on the belief that they were buying oil at $1 or -$10 or whatever the lows were.

They didn’t realize they weren’t buying May oil. They were buying June, which is trading at $21.12.

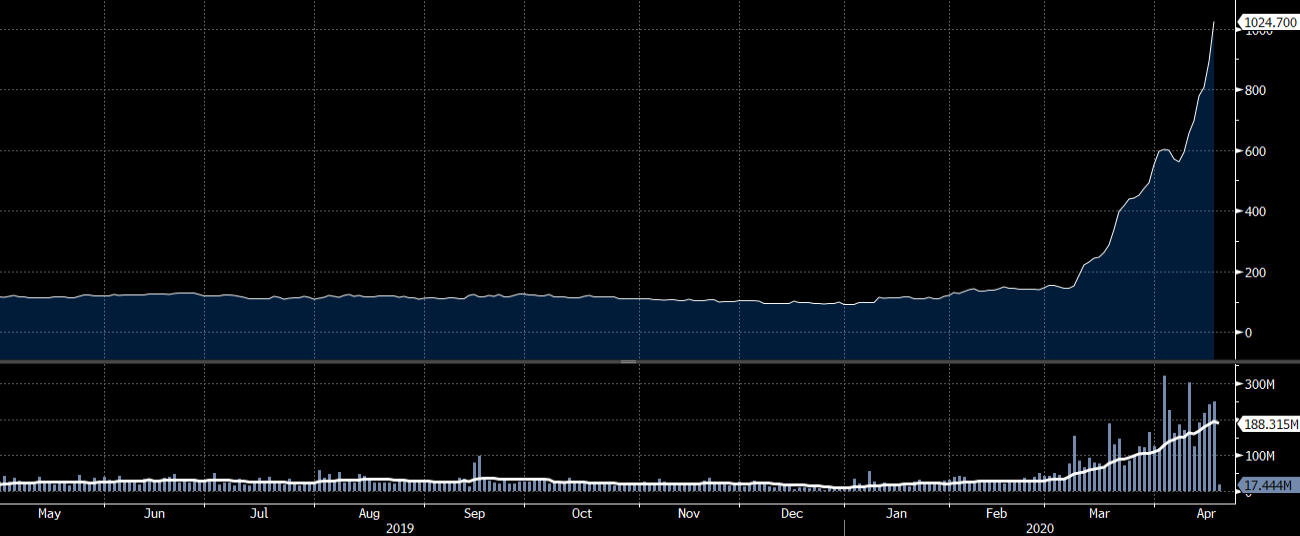

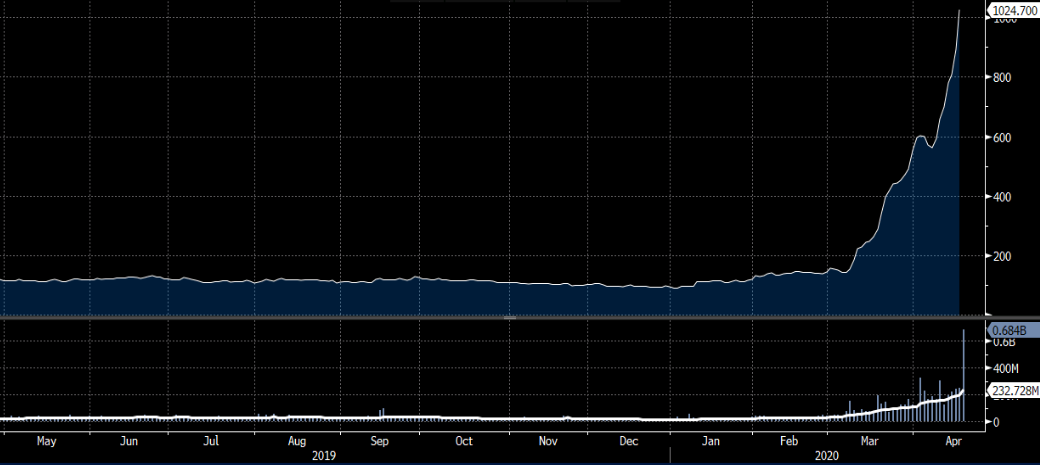

What’s worrisome is that the USO ETF now owns a large portion of the June contract. Coming into the day it was around 30% but there are signs it could be even more today. The ETF filed today to authorized an increase to shares outstanding to 4 billion. That’s after a surge above 1 billion since March and from 120 million at the start of the year.

That chart will be updated again tomorrow and we’ll get a better idea.

In all likelihood, retail traders have continued to pile into USO and other oil ETFs. At some point they’re going to throw in the towel or something is going to go wrong at the ETF itself. At one point today it was trading at more than 10% above net asset value.

Funds in trouble

The other thing to watch out for is funds blowing up or even problems at the CME. Oil is traded with high levels of margin. Even though most specs would have moved to June, there were still good flows in May and someone is clearly on the wrong side of that. We need to find out who was holding the bag.