Archives of “April 23, 2020” day

rssUK April flash services PMI 12.3 vs 27.8 expected

Latest data released by Markit/CIPS – 23 April 2020

- Prior 34.5

- Manufacturing PMI 32.9 vs 42.0 expected

- Prior 47.8

- Composite PMI 12.9 vs 29.5 expected

- Prior 36.5

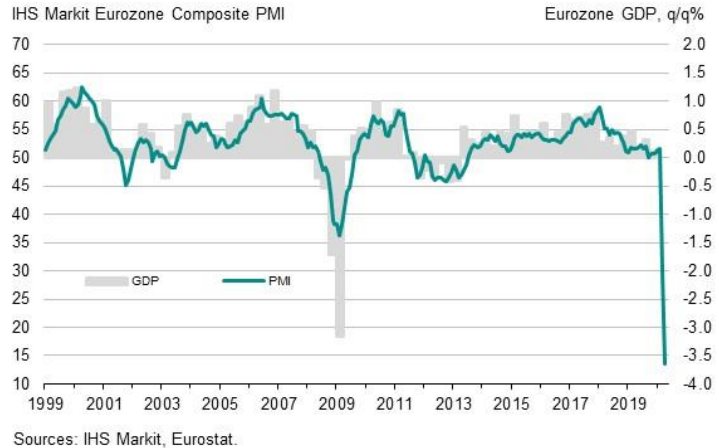

Eurozone April flash services PMI 11.7 vs 22.8 expected

Latest data released by Markit – 23 April 2020

- Prior 26.4

- Manufacturing PMI 33.6 vs 38.0 expected

- Prior 44.5

- Composite PMI 13.5 vs 25.0 expected

- Prior 29.7

The poor readings here have been forewarned by the dismal French and German releases earlier, as we see an unprecedented collapse in the Eurozone economy.

The services and composite prints are at series lows while the manufacturing print sits at a 134-month low, though manufacturing output crumbled to its lowest on record.

Again, this is all largely due to the virus outbreak situation and lockdown measures causing businesses to close – resulting in a collapse in demand and supply.

Markit notes that:

“The extent to which the PMI survey has shown business to have collapsed across the eurozone greatly exceeds anything ever seen before in over 20 years of data collection. The ferocity of the slump has also surpassed that thought imaginable by most economists, the headline index falling far below consensus estimates.

“Our model which compares the PMI with GDP suggests that the April survey is indicative of the eurozone economy contracting at a quarterly rate of approximately 7.5%.

“With large swathes of the economy likely to remain locked down to contain the spread of COVID-19 in coming weeks, the second quarter looks set to record the fiercest downturn the region has seen in News Release Confidential ‘ Copyright © 2020 IHS Markit Ltd Page 3 of 4 recent history.

“Hopes are pinned on containment measures being slowly lifted to help ease the paralysis that businesses have reported in April. However, progress looks set to be painfully slow to prevent a second wave of infections. In the face of such a prolonged slump in demand, job losses could intensify from the current record pace and new fears will be raised as to the economic cost of containing the virus.”

Global Silver Production Costs

Trend Break

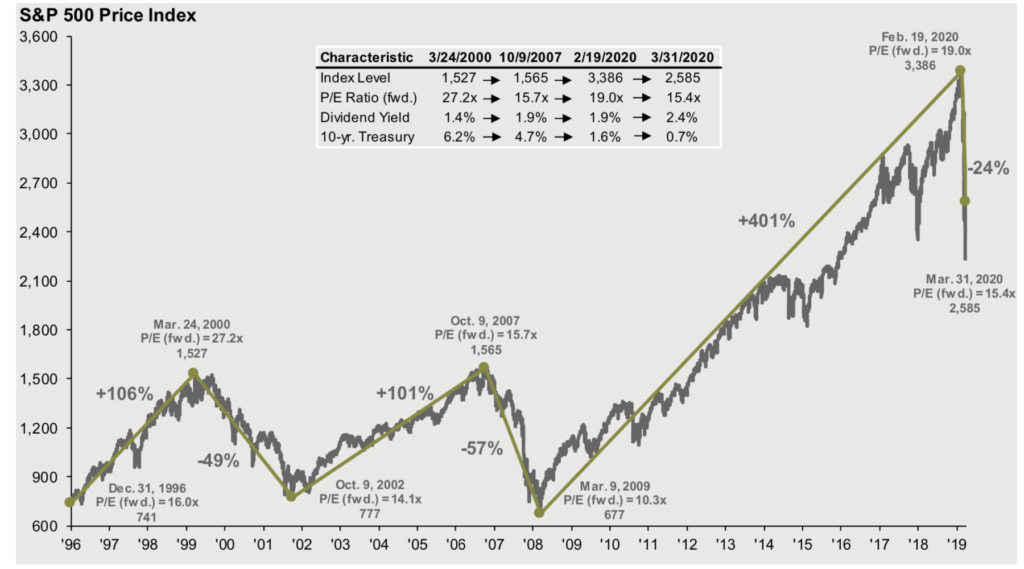

I have been showing various graphs from the Big Book of Charts – or as it is formally known, JP Morgan’s quarterly interactive “Guide to the Markets” —

But that chart above? Man, I don’t ever recall seeing anything remotely like that in US, Even 2008-09 took 18 months to progress.

Germany’s Merkel: We will have to live with the virus for a long time

Comments by German chancellor, Angela Merkel

- We are not in the end phase of the pandemic

- The question of the coronavirus will be with us for a long time in politics

- International cooperation on coronavirus is extremely important

- We can’t return to daily life similar to before the virus outbreak

- Let’s remain clever and careful in the pandemic

This is Merkel coming out once again to manage public expectations on the easing of lockdown measures in the country. She has previously said that it will be gradual so this fits with that narrative and to try and increase awareness that there will be a new “normal”.

Nikkei 225 closes higher by 1.52% at 19,429.44

A positive day for Asian equities

This follows the better performance in Wall Street in overnight trading but also as we see some calmer tones towards the start of European trading today.

The Hang Seng is up by 0.5% while the Shanghai Composite is up by 0.2% currently.

US futures pared earlier losses but are still keeping near flat levels for the moment. In the currencies space, the dollar is mildly weaker with AUD/USD near the highs still at 0.6342.

Over to Treasuries, there are still some tepid tones there with 10-year yields keeping slightly near flat levels around 0.614% at the moment.

The danger of debt becoming more expensive as GDP drops for emerging markets

South Africa’s debt financing is becoming more expensive

It is an obvious problem. When income is high enough we can finance debt. However, when times are hard not only does income drop, but debt also becomes more expensive. Repayments go up because you are now a riskier borrower. It is the double edged sword of debt that can get you in big trouble. Adam recommended a book recently which really outlines this problem.

And the money kept rolling in (and out). Having read the book it really outlines so clearly the problem that emerging markets have in trying to break free of this debt/bust cycle. If you want to see how the World Bank, IMF and Wall Street work together to ‘support’ emerging markets then read this book. It will also really underscore how bonds can work to really create an uphill struggle for emerging markets when bond yields rise and make borrowing more riskier as well as attracting predatory investors keen to capitalise on a country’s weakness.

South Africa is potentially facing a similar problem to Argentina. The yield curve is steepening as South Africa embarks on a $26billion plan to support the economy.

The funding for that plan is due to come from reallocations within the budget , loan guarantees to banks, the World Bank, the IMF as well as other domestic and international lenders. All well and good to take the loans when times are good. However, the forecast is for a -6.1% contraction this year which will leave a large tax revenue shortfall. This will mean that Government debt could climb to 80% of GDP from around 62%. The problem comes that a vicious spiral can quickly emerge: Falling income, leads to greater borrowing, leads to higher bond yields, leads to steeper repayments. Eventually the bubble bursts and the cards come falling down. Sadly, a number of emerging markets are going to be experiencing this problem going forward. This is one area to watch for SA and hopefully the selective default that Argentina implemented won’t be repeated.

French finance minister: We want all retail outlets to be able to open by 11 May, except bars and restaurants

Comments by French finance minister, Bruno Le Maire

That’s a little over two weeks from now. It sounds good on paper but the government also has to ensure that proper precautionary measures are put into place in the meantime. Otherwise, the risk is that there may be a secondary outbreak in the country.

Iran projectile launch – US says its a military satellite put into orbit

CNN with the report that Iran has successfully launched a military satellite into orbit for the first time

- citing two US Defense Department officials

More:

- the country’s space program utilizes the same technology that would be needed to launch an intercontinental ballistic missile, which would increase Tehran’s capability to strike enemy targets.

- US Space Command is tracking two objects in orbit that were launched from within Iran, according to one of the officials

- One is a rocket body and the other is assessed to be the satellite.