Supply chain issues a part of the story

There’s a risk-free arbitrage available in buying gold and selling it in the futures market but few are taking advantage of it.

You could buy 100 ounces of gold at spot and sell on futures contract and pocket $6400 in June.

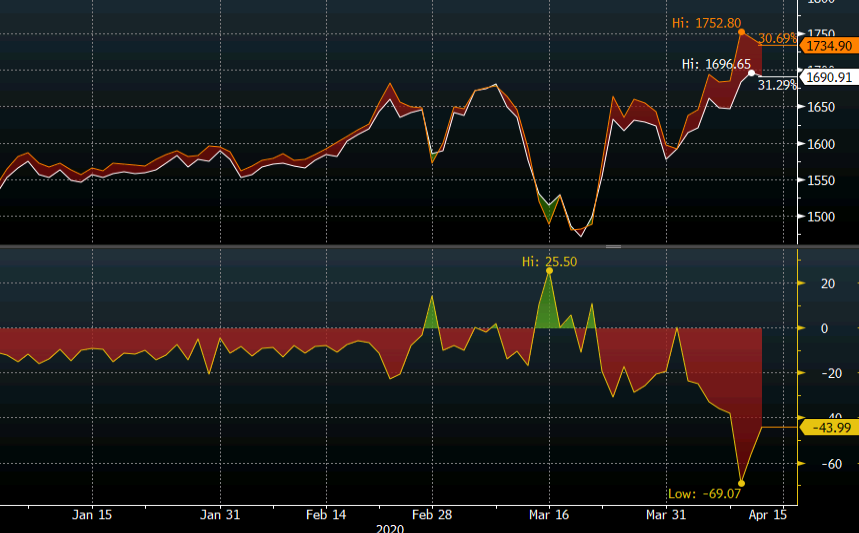

Spot trades at a $44 discount to the futures market and the issue appears to be in supply chains and refining. Spot is at $1691 and futures are at $1734 after hitting $1753 to mark a multi-year high.

This chart shows the relationship over time.

The only reason you wouldn’t do the trade is because you’re worried you couldn’t have 100 ounces of deliverable gold in June.

The reason is that refineries are off-line because of staff coronavirus worries.

For traders, the question is how the spread will narrow — with spot rising to the futures prices or futures coming down to spot. In the past week, the answer has been futures sliding but it bears close watching.