Oil headlines will be the main thing to watch today

The latest development from yesterday was that Mexico is playing hard ball and that is currently threatening the OPEC+ proposal put forward ahead of the meeting later.

OPEC+ members have called for international producers to rally on their side but at this stage, there’s no real certainty about what could happen next given the twist yesterday.

Either way, don’t expect any output cuts agreed to compensate for the loss of demand due to the economic shutdowns globally at the moment.

Whatever we are seeing will just help to ease the bleeding but the longer the global economic situation continues in this fashion, the weight of the supply glut will continue to grow heavier for oil prices. WTI crude fell by 9% yesterday, closing near the lows at $22.76.

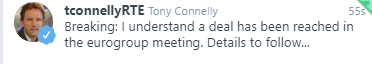

There were reports about deep rifts between the north and south. This is a big turnaroud. The details are important though, they could have a ‘deal’ on some token measures.

There were reports about deep rifts between the north and south. This is a big turnaroud. The details are important though, they could have a ‘deal’ on some token measures.