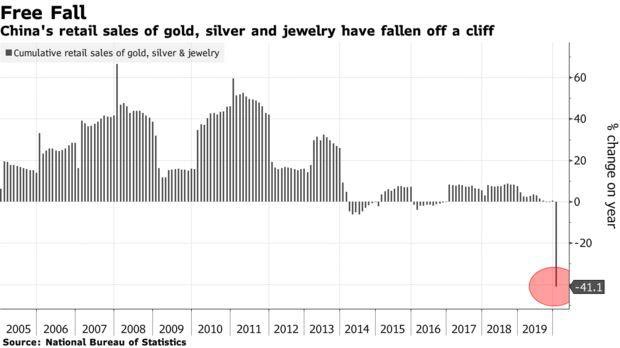

A trading range of 1052 pips

The USDJPY is finishing up a month where the low to high trading range has totaled 1052 pips. That is the 3rd highest range going back 10 years and the highs in trading range since November 2016 (US election month). The total range for 2019 was 939 pips. So one month, the range was bigger than one year.

Looking at the monthly chart above, the high for the month stalled near the high from last month and a trend line connecting the 2017 high and the high from February. That trend line cuts across at 112.06. The high for the month reached 111.71. Stay below, helped put a stall in the rallly. In the new month that trend line will cut across at 111.89, and a move above will be needed to give buyers more upside confidence.

On the downside this month, the price moved below the 100 month (at 105.55) and 200 month MA (at 104.06) after testing the MA twice in 2019 and bouncing. In 2018, there was two intra-month dips below the MA, but no closes below that MA level.

This month will also not close below the 200 month MA again (it has not closed below the MA since October 2016), but it did seriously break the MA in the month. The sellers had their shot to send the pair lower and weaken the technical bias from a longer term perspective, but they failed.

In the new month, it will take a move back below those monthly moving averages to hurt the longer term technical picture.