What an active day:

- The Fed cut rates 1% in the Asian session, surprising the market.

- The Fed announced quantitative easing to the tune of 500bn Treasuries & 200bn MBS

- The Fed announced that banks can borrow from the Discount window for up to 90 days

- They added liquiidity via daily repo action. The Fed basically said, whatever you need, we will provide

- Later in the day, the Senate Democrats offered a $750B stimulus package (TBD how it progresses).

So what happened in the markets?

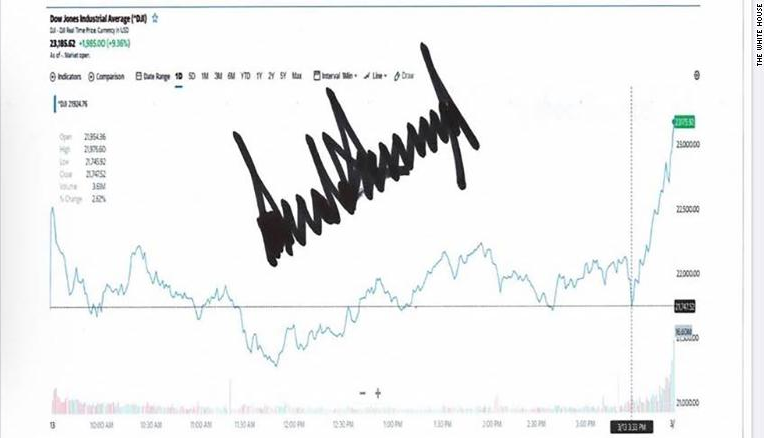

Stocks plummeted

- The Nasdaq had its worst day ever.

- The Dow and the S&P % decline was the worst since 1987

- The Dow’s point drop was the worst point loss ever

Many superlatives, but unfortunately they are all negative.

The numbers at the close are showing:

- Dow industrial average fell 2997.10 points or -12.93% to 20188.52.

- S&P index fell -324.89 points or -11.98% to 238-6413

- Nasdaq index fell -970.28 points or -12.32% at 6904.59

In the US debt market, not only did yields tumble with the 10 year leading the way at -23.4 basis points….

…but the spreads between European and US started to converge. European 10 year yields were mostly higher with Germany up 8.3 basis points and France up 14.8 basis points. The combination has pushed those levels closer and closer.

In the gold and precious metals market, prices fell.

- Spot gold had a volatile day and is closing down $-18.46 or -1.21% at $1511.37. The high for the day was up at $1575.47 while the low extended all the way down to $1451.55

- Spot silver also traded violently. It is closing at $12.90, down $-1.81 or -12.35% It traded in a $3.30 trading range. The high reached $15.15, while the low extended to $11.80. Crazy volatility

The oil markets were also volatile and moved lower as Saudi Arabia said they were not backing down from production cuts. The final numbers are showing:

- WTI crude oil futures $28.70. $-3.03 or -9.55%. The high price reached $33.75. The low price extended to $28.10.

- Brent crude oil is trading at $29.52, or $-4.33 or -12.79% on the day. It’s high price extended to $35.84 while the low fell to $29.50.

Finally in the forex market, the flows so the JPY and the EUR benefit the most. They were the strongest of the major currencies. The JPY benefited from the Pavlovian flight into the “safety of the JPY”. The EUR is a bit of a head scratcher as it is the current epicenter of the coronavirus.