Archives of “March 2020” month

rss“Just to put things in perspective: In the long run, the ‘coronacrash’ seems like a normal crisis, at least so far.”

ECB’s Lagarde says there are no limits, determined to use full potential of our tools

European Central Bank President Lagarde

- extraordinary times require extraordinary action

- there are no limits to our commitment to the euro

- we are determined to use the full potential of our tools within our mandate

The news:

ECB announces a new coronavirus pandemic response, EUR750bn purchase program

Ms No Limits with Mr Whatever It Takes

The stock market is usually not wrong in elections.

ECB announces a new coronavirus pandemic response, EUR750bn purchase program

European Central Bank announcement

- €750 billion pandemic emergency purchase programme (PEPP)

- a new temporary asset purchase programme of private and public sector securities to counter the serious risks to the monetary policy transmission mechanism

- purchases will be conducted until the end of 2020 and will include all the asset categories eligible under the existing asset purchase programme

- says for the purchases of public sector securities, the benchmark allocation across jurisdictions will continue to be the capital key of the national central banks.

- says to the extent that some self-imposed limits might hamper action that the ECB is required to take in order to fulfil its mandate, the governing council will consider revising them to the extent necessary

- says at the same time, purchases under the new PEPPwill be conducted in a flexible manner. this allows for fluctuations in the distribution of purchase flows over time, across asset classes and among jurisdictions.

- says a waiver of the eligibility requirements for securities issued by the Greek government will be granted for purchases under PEPP.

- says the governing council is fully prepared to increase the size of its asset purchase programmes and adjust their composition, by as much as necessary and for as longas needed

- the governing council will terminate net asset purchases under PEPP once it judges that the coronavirus covid-19 crisis phase is over, but in any case not before the end of the year

- says to expand the range of eligible assets under the corporate sector purchase programme (CSPP) to non-financial commercial paper, making all commercial papers of sufficient credit quality eligible for purchase under CSPP

- says the governing council of the ECB is committed to playing its role in supporting all citizens of the euro area through this extremely challenging time

Summary Headlines via Reuters

ES futures have flipped around to positive on this supportive announcement after losing ground earlier on the reopening for evening trade.

—

There are plenty of responses to these sorts of actions along the lines that they will not ‘cure’ the coronavirus. Correct. Central banks are applying band-aids to mitigate (hopefully) the impacts upon econiomies, doing what they can do. Don’t expect Lagarde, Powell, et al find a miracle medical cure, K?

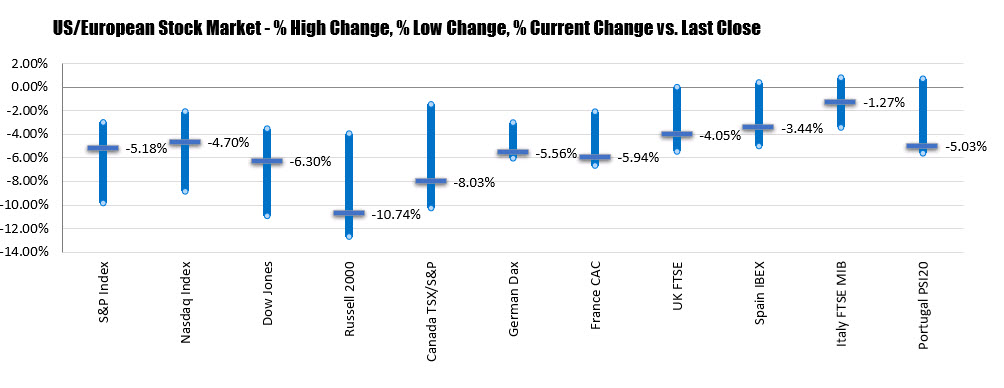

US stocks have another wild ride in trading today

Big swings in the major indices

Another down day with wild up and down swings.

- S&P index closed the day at 2398.10. That was down 131.09 points or -5.18%. The low for day took the price down -9.83%. The high for the day peaked at -2.99% for the day.

- NASDAQ index closed the day at 6989.84. That was down -344.93 points or -4.7%. The low for the day saw the index fall -8.84%. The high for the day peaked at -2.07% for the day.

- Dow closed at 1908 98.92 points. That was down -1338.46 points or -6.3%. The low for the day so the index fall – -10.92%. The high for the day peaked at -3.52% for the day

Thought For A Day

Guess what happens here if CME Clearing goes bust..

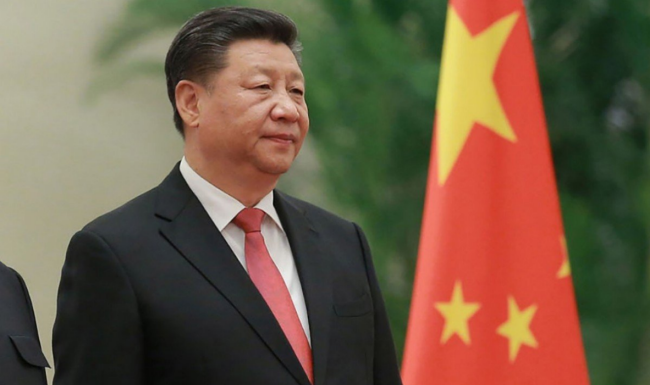

China president Xi: Global virus outbreak poses new threat to Chinese economy

Comments by China president Xi Jinping

- China should adjust policy focus as needed

- Says that Wuhan should gradually push forward with production resumption

- Says that downward pressure to Chinese economy has risen

Even if China is starting to slowly come back online, it wouldn’t do their economy much good if the rest of the world starts to go offline.

For China, it is about trying to strike a balance now as they need to get domestic conditions back up to try and support the economy as international demand/supply starts to dwindle.

Italy reportedly may extend lockdown beyond 3 April

La Stampa reports

The report says that Italian prime minister Conte may extend a national lockdown beyond 3 April as coronavirus cases continue to climb in the country. For some context, Italy crossed the 30,000 mark in terms of confirmed cases as of yesterday.

Anyway, the report adds that Conte is likely to maintain current measures, which includes travel restrictions and closure of schools, as the country tries to curb the spread.