The Fed and the US-China trade war have been the two defining forces in driving gold direction this year

Despite the fact that the Fed has shelved its so-called mid-cycle adjustment and the US and China have reached a Phase One trade deal, gold looks set to end the year with over 15% gains – rising from ~$1,280 to ~$1,485 currently today.

It has been quite the journey upwards for gold this year and I dare say that most market participants would not have thought that at the end of last year. This has been one of the trades that markets only began to get right at the start of June this year.

We talked about the reasons why at the time and how the run higher in gold still has legs to go, especially if the Fed delivers on a more easing bias:

And boy, did the Fed deliver. The rate cuts may be somewhat politically motivated but at the end of the day, it is what it is and you can only trade what is in front of you.

The upside in gold this year stalled at ~$1,550 around mid-September as Fed rate cut talks begin to temper down looking towards next year and as US-China trade talks started to find some progress towards a potential deal.

Eventually, both factors also flipped around the Fed is now on pause – possibly until the end of next year – while US and China looks set to sign off on the Phase One trade deal.

So, what’s next for gold as we approach 2020?

If there’s a lesson to be taught for gold traders this year, it is one on the importance of adapting. As the market landscape changes, we as traders must adapt to that and be ready to catch the shift and capitalise on the opportunity at hand.

As things stand, there are a couple of reasons to not expect gold to run back higher as we saw from June to September this year:

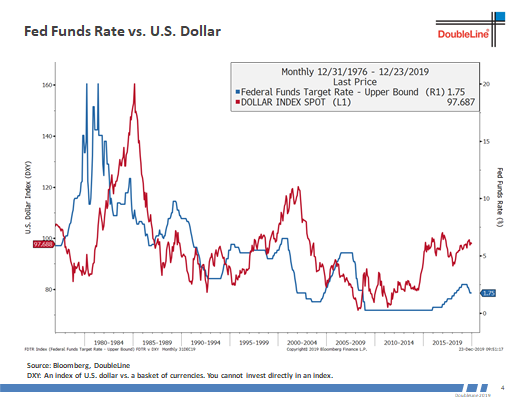

1. Fed is not seen cutting rates any time soon

2. Global economy is seeing some green shoots amid the economic slowdown

3. US-China trade war has reached a temporary ceasefire

In my view, the potential downside for gold here is if the global economy starts to pick up again next year. That will see more flows go back into emerging markets (and risk assets) and away from safety assets and growth will be the main story once again in global markets.

In that lieu, keep an eye out on key leading economic indicators. A break below $1,450 and $1,400 especially in gold may precipitate more weakness back towards $1,250 to $1,300 in the medium-to-long term next year – provided those factors above stay the course.

The worst-case scenario for traders is that global growth continues to remain subdued but isn’t deteriorating much more. Essentially, that puts us in this low growth environment but no imminent threat of a major recession.

This half-dead global economy will leave plenty of waiting and wandering instead of chasing any firm moves based on changes in the fundamental direction.

Is there any chance for gold to run higher next year?

Most definitely and once again, it’s contingent on the three factors above. Imagine this scenario instead of what we’ll get above next year:

1. Fed eventually continues cutting rates

2. Global economy pickup is nowhere near what it should be, weaker signs still persisting

3. US-China trade truce is broken and tensions escalate again

Right now, these are not really the “base case” scenario for gold but much like what we saw this year, it is important to pick up on the change in the market landscape because that can lead to the sort of run we saw in gold from June to September.

Who’s to say that it may not happen again next year? What are your thoughts on gold as we look towards 2020? Feel free to share them in the comments below.