100 dollars of 1913 would only be worth around 3.87 dollars today.

“The central case for December is very much ‘on hold’, particularly given that we expect the ECB to make only modest tweaks to its forecasts,” they write.

Given these effects of lower interest rates and the long and variable lags in the transmission of monetary policy, the Board decided to hold the cash rate steady at this meeting while it continues to monitor developments, including in the labour market. The Board also agreed that due to both global and domestic factors, it was reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.

The easing of monetary policy since June is supporting employment and income growth in Australia and a return of inflation to the medium-term target range. Given global developments and the evidence of the spare capacity in the Australian economy, it is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board will continue to monitor developments, including in the labour market, and is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.

The preliminary report can be found here. A more positive revision here as preempted by the French and German readings earlier but overall factory conditions are still more subdued despite the bit-part recovery.

Says that OPEC+ is discussing to deepen the current set of output cuts by at least 0.4 mil bpd until June next year as Saudi Arabia is keen to surprise the market to the upside before the Saudi Aramco IPO.

Chinese PMI’s to re-energise markets

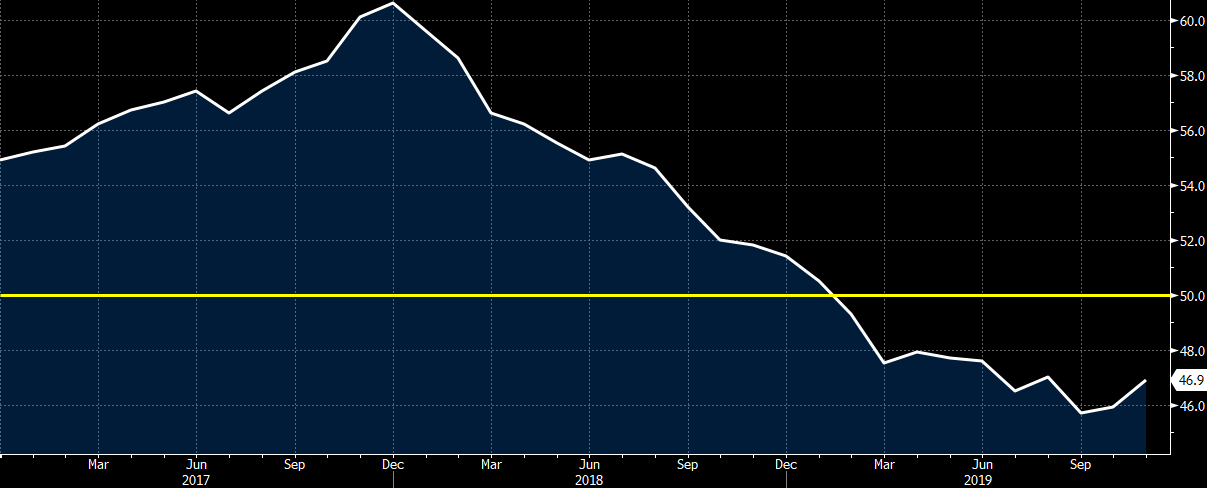

According to Bloomberg’s Market Live blog the manufacturing PMI’s had been expected to signal contraction this month and services PMI were expected to show a small pick up for October. Note that the Caixin manufacturing data out is the private surveys of smaller to medium Chinese businesses. The recent run of services PMI data for the Caixin data out on Wednesday has shown a steady decline since May this year. So, a beat there and we will have a full dose of good news from the latest Chinese PMI data.

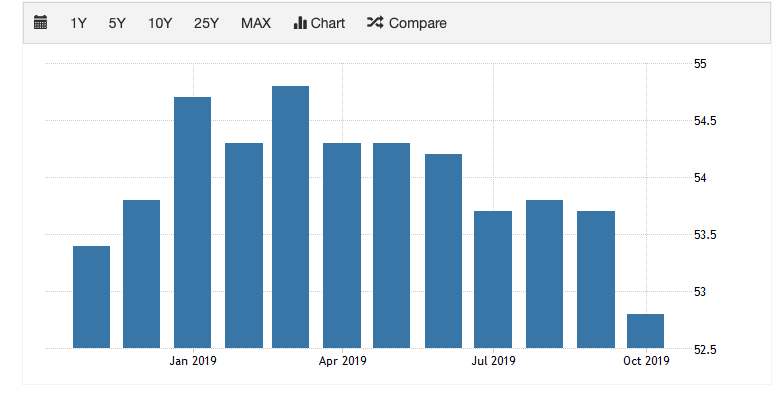

The Caixin manufacturing data has shown a pick up in the last couple of months. October saw a beat of 51.7 vs 51.0 expected with both output and new orders expanding at steeper rates. The official manufacturing PMI release showed an expansion for the first time in 8 months at 51.8 vs 51.5. The services data showed a beat too at 54.5 vs 53.1 showing the highest reading since March. Any surprises to the downside with the PMI’s would have raised alarm bells. This surprise to the upside will alleviate nerves. The immediate response has been a buoyant Asian equity market. The Nikkei is up +1.01%. the Hang Seng +0.42% and the Shanghai Comp. +0.13%. This is a positive risk development, but may make China slightly more robust in US-China trade negotiations with the US in a similar way that stronger US data hardened President Trump’s hand.

The Caixin manufacturing data has shown a pick up in the last couple of months. October saw a beat of 51.7 vs 51.0 expected with both output and new orders expanding at steeper rates. The official manufacturing PMI release showed an expansion for the first time in 8 months at 51.8 vs 51.5. The services data showed a beat too at 54.5 vs 53.1 showing the highest reading since March. Any surprises to the downside with the PMI’s would have raised alarm bells. This surprise to the upside will alleviate nerves. The immediate response has been a buoyant Asian equity market. The Nikkei is up +1.01%. the Hang Seng +0.42% and the Shanghai Comp. +0.13%. This is a positive risk development, but may make China slightly more robust in US-China trade negotiations with the US in a similar way that stronger US data hardened President Trump’s hand.The Chinese foreign ministry is said to have suspended the review of the request of American maritime vessels as well as the review of American military aircraft visiting Hong Kong, according to Reuters.