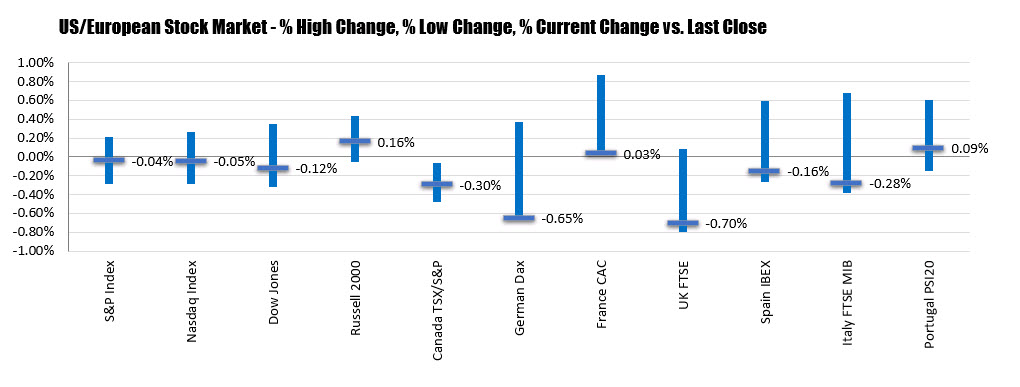

German Dax -0.65%. UK FTSE -0.7%

The major European shares are ending the session with mixed results but near lows for the day. The provisional closes are showing:

- German DAX, -0.65%

- France’s CAC, unchanged

- UK’s FTSE, -0.70%

- Spain’s Ibex, -0.16%

- Italy’s FTSE MIB, -0.28%

- Portugal’s PSI 20, +0.1%

Meanwhile in the US, the major indices are also lower but they are off the lows for the day. Below are the changes in ranges on a percentage basis for the major European and US stock indices.