But don’t count on any big surprises by the Fed today

It’s the final FOMC meeting of the year but it could be the most lackluster one yet as the Fed looks set to reiterate a similar message to the October meeting.

Since then, we have come to know that the Fed has shifted its threshold for viewing inflationary pressures. As such, don’t look towards aggressive rate hikes being in the base case for next year considering where inflation is resting at the moment.

On the other hand, given the resilience of the US economy, rate cuts should also not be on the horizon but are probably seen as more of a defensive measure perhaps – just in case.

However, on the balance of things, that should point towards the Fed being more neutral going into next year and the dot plots should very much reveal that.

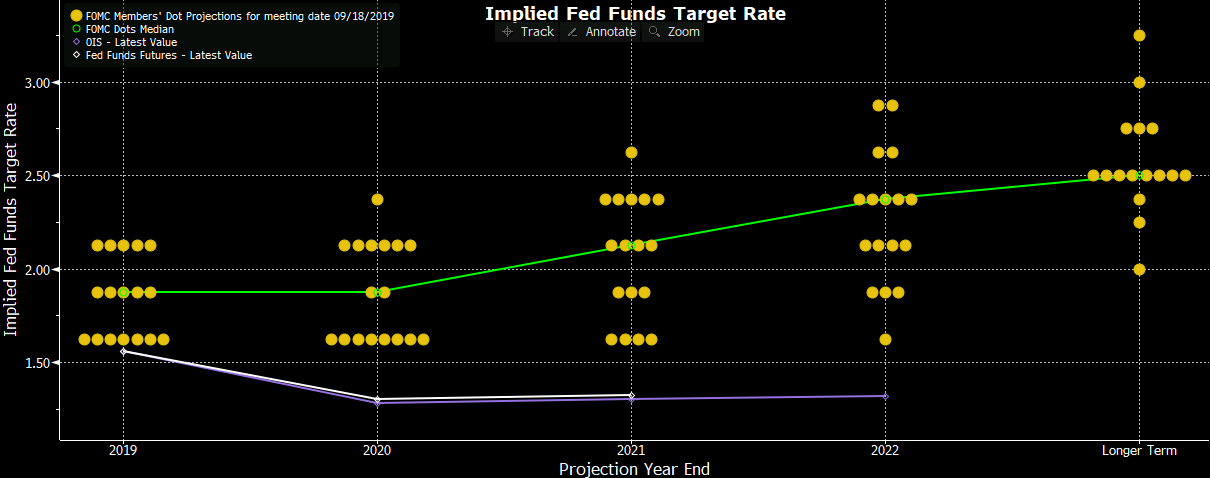

The expectation going into the meeting is that the minor changes in the statement and economic projections should produce minimal changes in the currencies and rates markets, so there is the potential for surprises this time around.

That said, I would not be counting on that. If anything, the dot plots should reveal a continued split in Fed projections but the median for next year perhaps should rest at 1.625% – showing no move in the Fed funds rate.

The other part to watch for in the dot plots will be the longer-term rate, which was seen at 2.500% back in September. If there is a bit of a skew higher there, it could lead to mild dollar strength but I would not expect any significant repricing in Fed funds futures.

In short, the threshold for a significant reaction to the Fed today is rather high and it would require a major surprise by the Fed – which is unlikely. There may be a couple of changes to the dot plots (next year and longer-term) but that is also unlikely to have a major impact on the dollar and rates in the bigger picture.