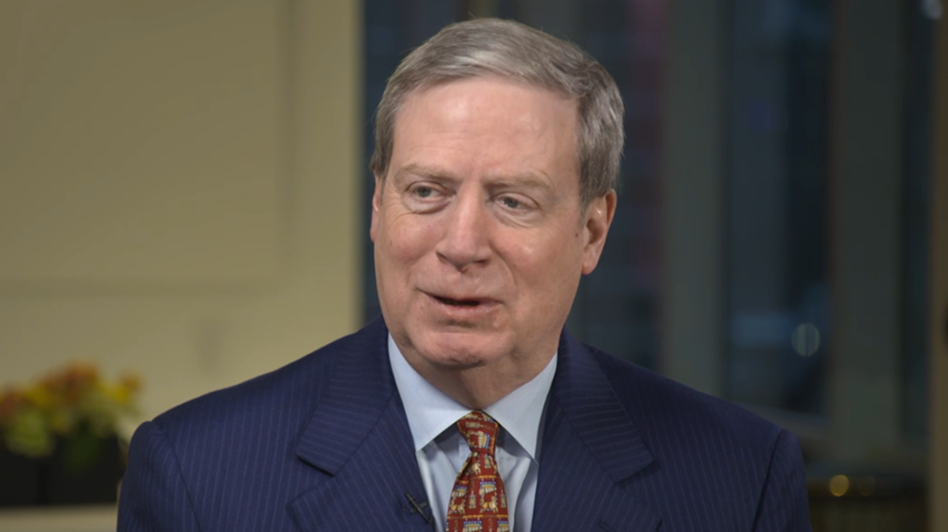

What the investing legend is doing in 2020

Stanley Druckenmiller says he was ‘timid’ in 2019 but still eeked out a double-digit return while relying on safer assets.

“I’m just too conservative in my old age,” he said. “I was well positioned but just too timid.”

His wagers for 2020 are on the Canadian and Australian dollars while shorting the yen and Treasuries. He also owns copper and equities from the US and Japan.

More recently, he bought the pound and UK banks. He said Brexit will ultimately be good for the UK economy.

Early in the year he reversed positions he had taken in late 2018 when he bought bonds, bet against financials and predicted a period of low returns.

“I couldn’t have been more wrong,” he said.

The main risks he sees are political, a turn in inflation that forces the Fed to hike and weakening credit. He said he doesn’t see any of that happening in the near term but “these things tend to happen after elections.”

I highly encourage everyone to watch the

full video (50 mins) because he makes many compelling points.