Major indices like a strong US and hopes for China US progress

The major European indices are ending the the week mostly lower. However, they are higher in trading today. Markets are liking the strong US job growth (good for global growth) and hopes that US, China trade progress can continue.

The provisional closes are showing:

- German DAX, +0.88%

- France’s CAC, +1.08%

- UK’s FTSE 100, +1.45%

- Spain’s Ibex, +1.60%

- Italy’s FTSE MIB, +0.9%

For the week, apart from the Spain’s Ibex, the major indices are ending with declines:

- German DAX, -0.5%

- France’s CAC -0.7%

- UK’s FTSE MIB -1.5%

- Spain’s Ibex +0.4%

- Italy’s FTSE MIB -0.3%

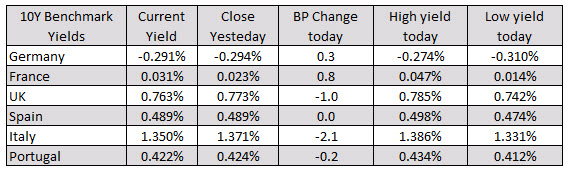

In the benchmark 10 year notes today, the yields are mixed. Germany France yields are marginally higher. UK Italy and Portugal yields are marginally lower. And Spanish yields are unchanged on the day.

A snapshot of other markets as London/European traders look to exit are showing:

- Spot gold down – $-16.60 or -1.12% at $1459.40. The stronger US job report has strengthened the US dollar and helped to send go price is to the downside

- WTI crude oil futures are trading up $0.74 or 1.27% at $59.17. After muddling along near unchanged levels, the prospects for stronger growth and OPEC production cuts has the contract moving back to the upside

In the US stock market, the major indices trade near high levels for the day:

- S&P index up 32.37 points or 1.04% at 3149.86

- NASDAQ index up 84.6 points or 0.99% at 8655.34

- Dow is up 335 points or 1.21% at 28012

In the US debt market, yields are modestly higher despite the strong jobs report (off high levels).

Forex markets, the USD is stronger but remains lower vs the NZD and the JPY. The CAD is the weakest after their employment report showed net job losses at the highest since 2009 and a spike higher and the unemployment rate to 5.9% from 5.5%.