China takes action in response to the HK bill passed by the US

The Chinese foreign ministry is said to have suspended the review of the request of American maritime vessels as well as the review of American military aircraft visiting Hong Kong, according to Reuters.

Adding that Beijing has also sanctions US NGO human rights watch for supporting the “extremist, violent activities” in Hong Kong.

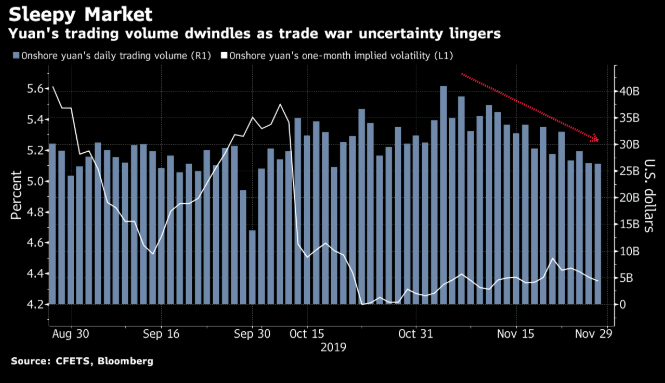

The headlines here are barely audible by markets at the moment as the more positive risk mood continues to reverberate into the European morning. That said, in terms of retaliatory action by China, this so far can be categorised on the mild side of things.

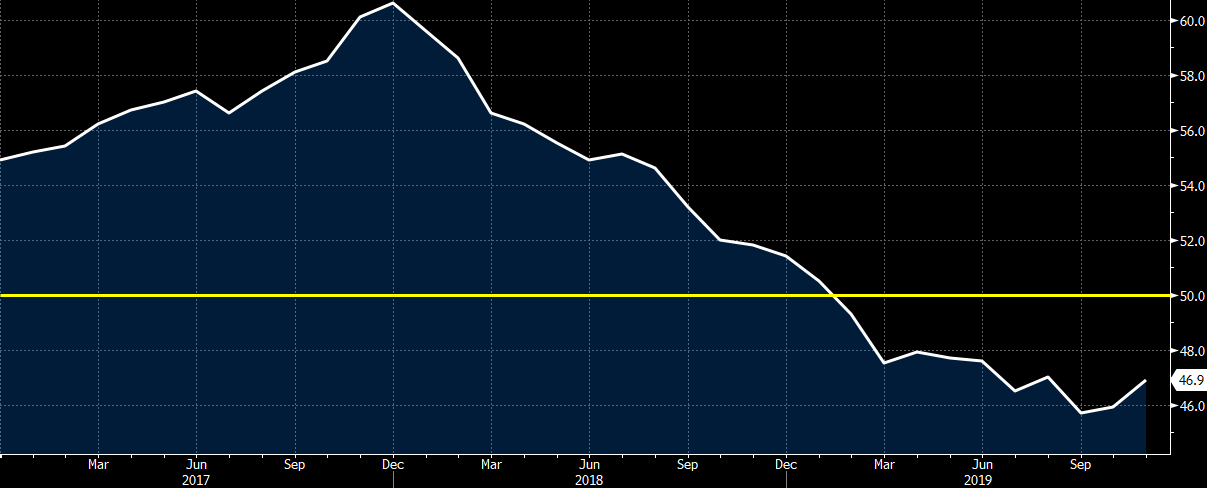

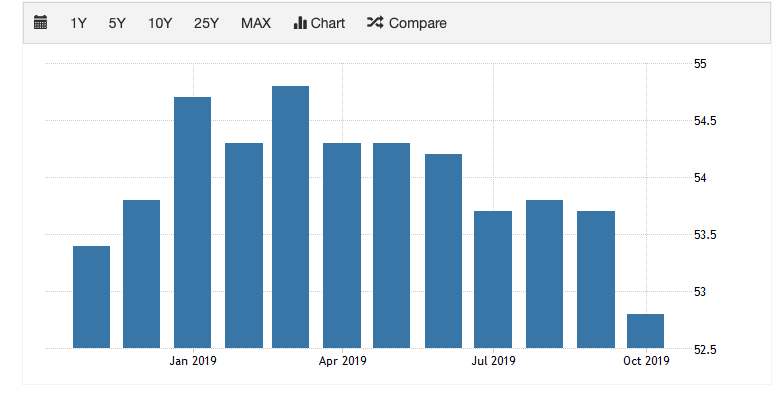

The Caixin manufacturing data has shown a pick up in the last couple of months. October saw a beat of 51.7 vs 51.0 expected with both output and new orders expanding at steeper rates. The official manufacturing PMI release showed an expansion for the first time in 8 months at 51.8 vs 51.5.

The Caixin manufacturing data has shown a pick up in the last couple of months. October saw a beat of 51.7 vs 51.0 expected with both output and new orders expanding at steeper rates. The official manufacturing PMI release showed an expansion for the first time in 8 months at 51.8 vs 51.5.