USD/JPY trades at its highest levels since 1 August

The pair remains underpinned as risk trades are looking perky to start the new week, with the S&P 500 hitting a record high and Treasury yields climbing on trade optimism.

That said, price is now running into key resistance from the 200-day MA (blue line) @ 109.06 and that will be the key resistance level to watch out for today.

If buyers can break above that on the daily close, the bias will shift towards favouring them for the first time since May this year.

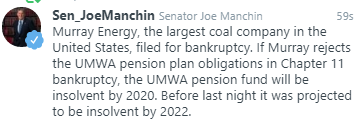

However, there are key risk events still to follow during the week with the Fed meeting decision notably still to come tomorrow.

Although a rate cut is a shoe-in at this point, it is all about the Fed communication on future rate decisions and that will be the spot to pay attention to for risk trades.

For today, there are also large expiries around 109.00-10 so that may help to keep price action limited around the figure level until they roll off.

If anything else, continue to keep your eye on Wall St to see if investors will push stocks to new record highs after a solid start yesterday.