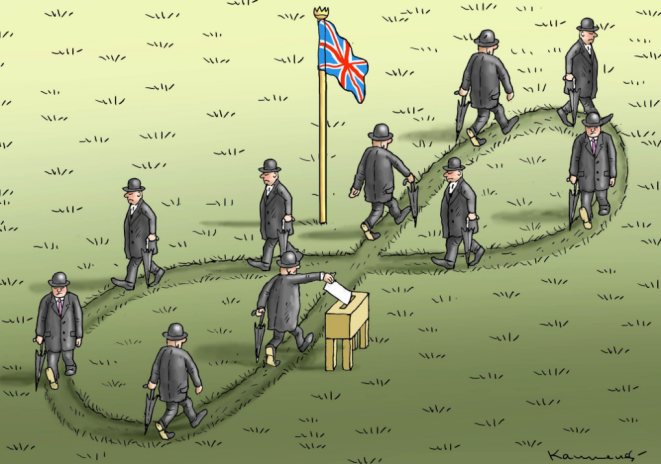

A light data docket to start the week as Brexit remains in focus

Happy Monday, everyone! Hope you all had a great weekend and are doing well today.

First thing’s first, don’t forget daylight savings has ended in most parts of Europe (clock goes back an hour) so hopefully you don’t mess up your schedule because of that.

Markets are keeping more steady once again as there will be plenty to look forward to in the week with the usual Brexit and US-China trade rhetoric at play, alongside key central bank meetings amid month-end flows.

As such, expect key headlines and the ebb and flow to dominate trading sentiment as there isn’t much on the economic calendar in the session ahead.

0700 GMT – Germany September import price index

Prior release can be found here. A proxy and lagging indicator of inflationary pressures. Not a major release by any means.

0900 GMT – Eurozone September M3 money supply

Prior release can be found here. A look at money supply/credit conditions in the euro area region. A minor data point at the moment.

0900 GMT – SNB total sight deposits w.e. 25 October

Your weekly check of the deposits kept at the SNB by Swiss banks. This data is a proxy for FX interventions.

1100 GMT – UK October CBI retailing reported sales

The readings here are an indicator of short-term trends in the retail and wholesale sector of the UK economy. A minor data point as Brexit remains the key focus.

That’s all for the session ahead. I wish you all the best of days to come and have a wonderful week ahead!