Powell offered some hints if you read between the lines

There is no real headline from Powell’s visit to Switzerland. He repeated the Fed’s refrain that it will act as appropriate to sustain the expansion. That’s something any Fed Chairman could have said any time in history and it wouldn’t change the picture.

However there was more between the lines than it appeared:

1) No recession

The Fed said it wasn’t forecasting a recession. I don’t know why this is news but it’s something that markets reacted to. Gold, in particular, came under some pressure and fell to $1510. There is no recession in the data.

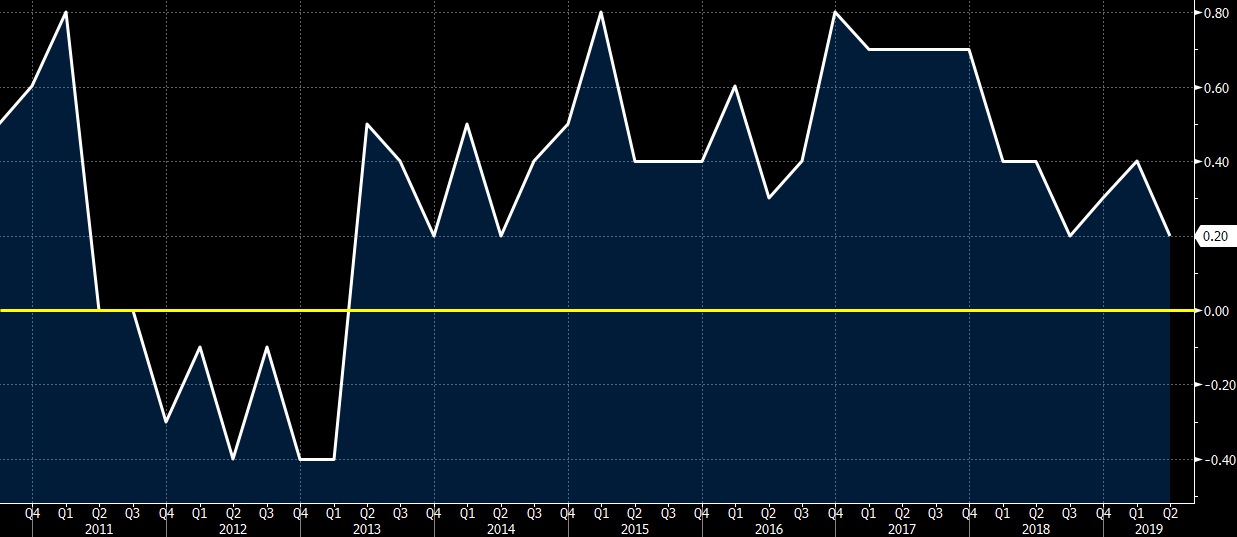

2) Moderate growth, doesn’t want inflation slipping

The Beige Book called growth modest but he said moderate, which is arguably better. More important was a comment that the Fed’s strategy is to avoid CPI expectations slipping with inflation bouncing around 1.5-2.0%

3) Change in tone on inflation

I think this is important. Powell talked about how the relationship between economic tightness and inflation has faded. He also highlighted that inflation is especially well anchored. This is an important long-term shift because it suggests that even if the trade war ends, the Fed now realizes that it doesn’t need to keep rates as high.

4) Geopolitical risks and data

This is mostly a nod to the trade war, which is entirely the reason that they’re cutting. He highlighted Brexit as well but that’s nothing new. Hong Kong was also something he noted but that’s hardly something that’s affecting the US.

5) A bit of humility

Powell highlighted that central banks don’t have much experience working through trade disputes. The subtext there is that they might be overreacting but that it’s the proper thing to do in terms of risk management.

6) No pushback

Powell knows that a cut is fully priced in. The central bank goes into the blackout period this weekend and this was the final word. He didn’t push bank against the market, which is an acknowledgement that a cut is coming. He also didn’t push towards 50 bps. I think a 25 bps move is a done deal now and the market reaction should be all about how he tees up the Oct 20 meeting. Another cut is 66% priced in then, which I think is on the high side… but it’s a long ways away.