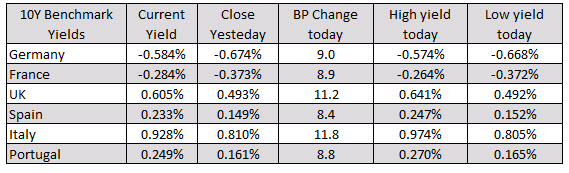

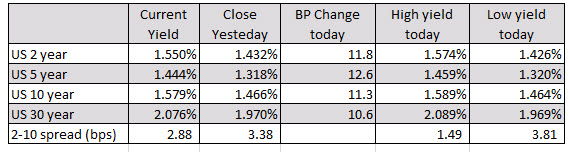

The Dollar Index fell the most in three months yesterday and is experiencing mild follow-through selling today. With hopes that Hong Kong has turned a corner, news that in-person US-China talks will resume next month, and a no-deal Brexit is well on the way to being averted, investor risk appetites are robust today. Global equities are higher as are benchmark yields, while gold is being pushed back below $1550. Most Asia Pacific equities advanced, though India and Malaysia were exceptions and Hong Kong saw a bout of profit-taking after yesterday’s surge. In Europe, the Dow Jones Stoxx 600 is advancing for the third consecutive session and the fifth in six sessions to trade at one-month highs. The S&P 500 has been crisscrossed the 2820-2950 range several times in recent weeks and is poised to gap above the top today. Interest rates are backing up, and the 10-year yields are 3-5 bp higher. The dollar is edging lower against most major and emerging market currencies. Among the majors, the yen and the Swiss franc are experiencing minor losses, while among the emerging markets, the Turkish lira is off about 0.25%. The lira may snap a three-day, five percent advance as Prime Minister Erdogan weighs in again on the need for aggressive rate cuts to ambitious growth hopes.

Asia Pacific

The PBOC’s dollar reference rate has been extremely stable in around CNY7.0850, and it is the market that blinked first. The dollar’s broad pullback yesterday saw the model projections eased below CNY7.0940. The onshore and offshore yuan has also converged near 7.1460. Chinese officials have been slower to roll-out additional stimulus than many observers have expected. We had thought there was a good chance of a cut in reserve requirements over the summer. Nevertheless, the State Council appears to be hinting of action soon, and a window of opportunity is seen before the October 1 national holiday.

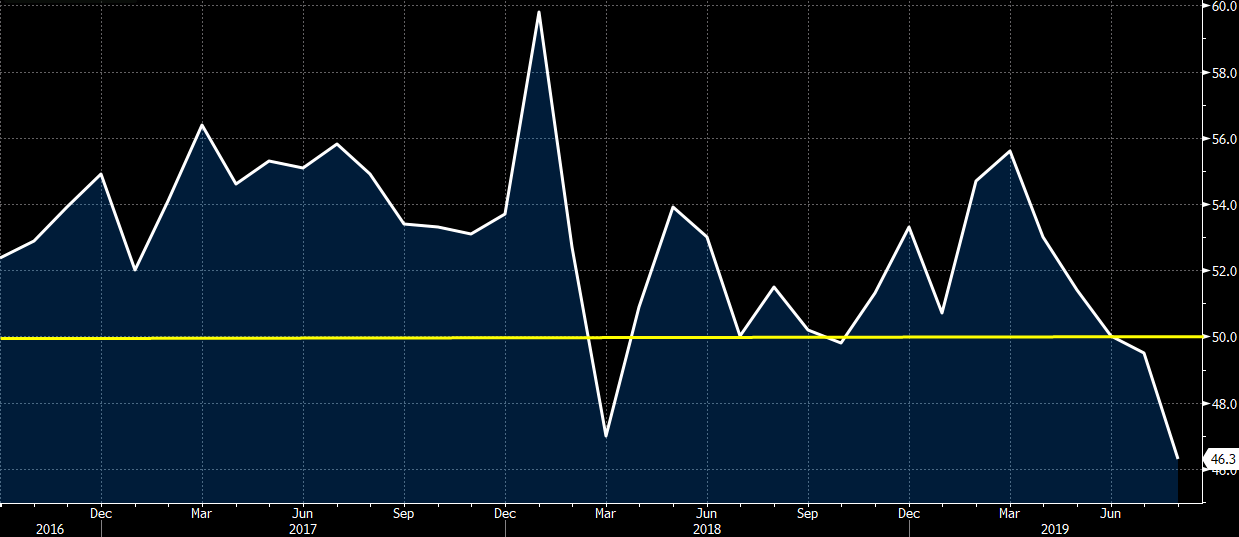

With the latest round of tariffs and counter-tariffs in the US-China spat going into effect on the start of the month, securing face-to-face meetings proved difficult. This had contributed to the pessimism. However, now Chinese officials will come to the US next month, according to reports. Still, the prospects of a deal are remote. Trust between the two at a low ebb after two tariff truces were ended by the announcement of new action on Twitter, and China shows reluctance to change fundamental behaviors. Separately, the US trade figures show that China was the third-largest buyer of US crude oil in June and July (buying 5.7 mln barrels and 7.1 mln barrels respectively). South Korea was the largest buyer, followed by Canada. China puts a 5% levy on US crude as of September 1.

(more…)