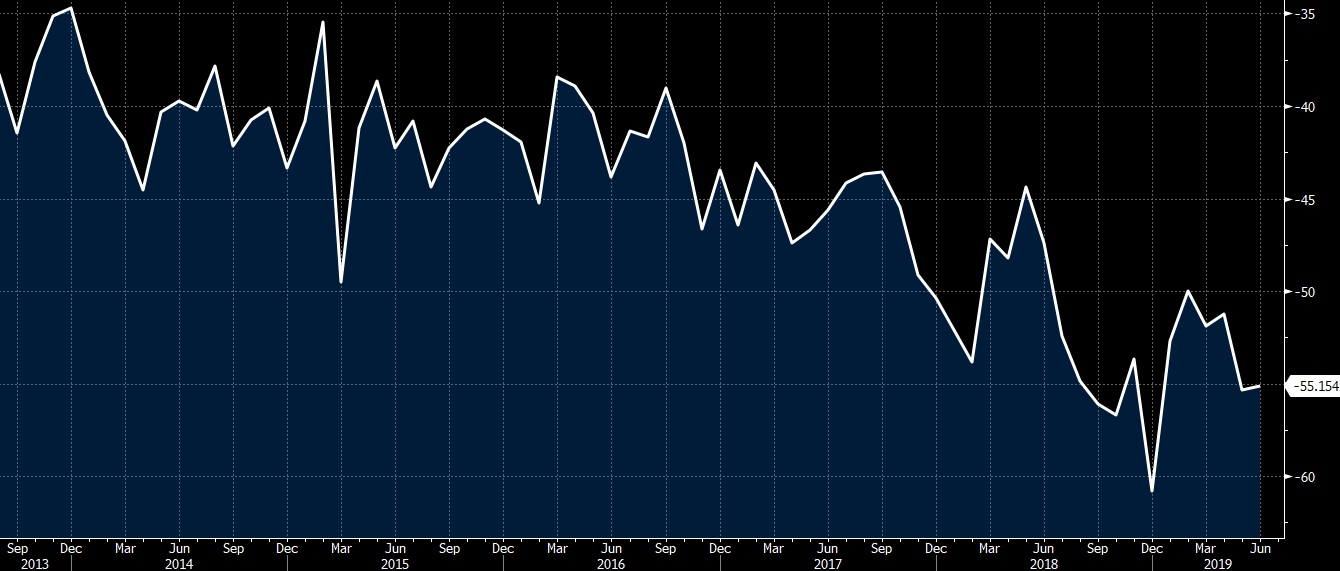

USD Trade Weighted Major Currency Index

This isn’t exactly a good news for the mini equity rally that was underway.

Tech was hit particularly hard but all markets had a decent rebound later in the day.

Here is the weekly look at the S&P 500:

It was a rough week as the ECB disappointed and the trade war ramped up. The measured target of that head-and-shoulders pattern points to a dip all the way to the June lows.

Both the foreign and commerce ministries said the US would have to “bear all the consequences”and demanded more sincerity from Washington if negotiations were to continue following the president’s latest announcement, which caught many in Beijing off guard.

Officials did not give details on the possible counter measures China would take, but observers said China would be less willing to buy US agricultural products, and could restrict exports of rare earths – a key material used in the manufacturing of hi-tech products such as smartphones .

It may also speed up the production of its list of “unreliable entities” – companies deemed to pose a threat to China’s interests – a measure that could target US firms and hamper their operations in China.

This is the closest to consensus I can ever remember a non-farm payrolls headline. When you factor in everything else, the good and bad also balance out. The revisions were negative but wage growth was upbeat. Unemployment rose but it was because of higher participation.