Flattish tones observed in early trades

- German DAX futures flat

- French CAC 40 futures +0.1%

- UK FTSE futures +0.3%

The gains today belie the more choppy market sentiment ahead of the Fed decision tomorrow as traders and investors are all waiting with bated breath on what the US central bank will decide and communicate to markets.

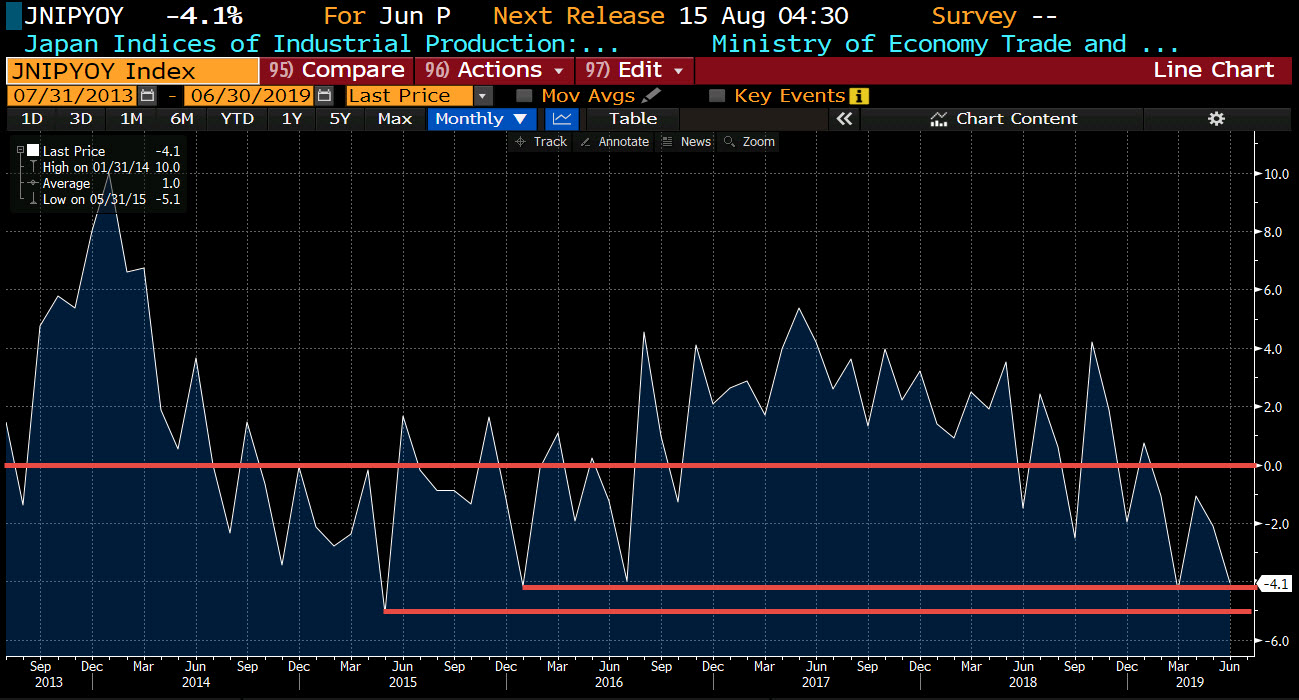

Japan industrial production fell more than expected in June. The preliminary release is showing a -3.6% decline versus -1.7% estimate. Last month industrial production rose 2.0%.

For the year, industrial production fell -4.1% versus -2.0% estimate. The prior month was at -2.1%.

“How then to position? We like EUR/JPY shorts at times of uncertainty and will stick with those. Decent US data and a dovish Fed ‘ought;’ to help those of us inclined to bottom-fish for cheaper AUD and CAD, even if neither of those positions has done us any favours in the last week. USD/CAD shorts look more secure than AUD/USD longs, but since July’s best currency so far is the Turkish Lira, despite a large CBRT rate cut, maybe yield-seekers are going for ‘proper’ yields and bypassing G10 currencies that yield less than the US anyway.”