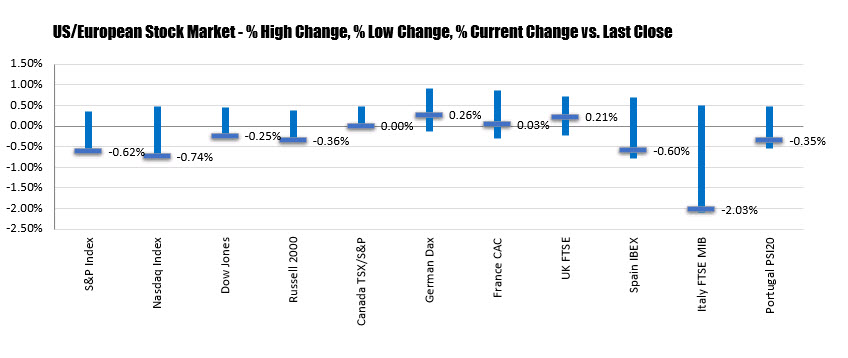

Every other G-20 index already peaked a long time ago. Macro imbalances abound as fundamentals are deteriorating. How long until US stocks catch up to the downside?

Every other G-20 index already peaked a long time ago. Macro imbalances abound as fundamentals are deteriorating. How long until US stocks catch up to the downside?

Standard Chartered has been accused of handling $56.8bn of dollars in allegedly illegal transactions with Iran-connected entities in a civil suit brought by whistleblowers against the bank.

The whistleblowers allege StanChart cleared far more transactions in violation of Iran sanctions between 2009 and 2014 than the U.S. government used as the basis for fines paid by the bank in April.

The new claim filed on Thursday piles further legal woes on the emerging markets bank which has been hit with a series of penalties by U.S. law enforcement and regulators in the past seven years for lax financial controls and for handling transactions for companies in Iran and other sanctioned countries.

In April StanChart agreed to pay $1.1bn to settle charges that it violated sanctions and ignored red flags about its customers, after a multiyear investigation that followed settlements with U.S. authorities in 2012.

The settlement included a guilty plea by a former bank employee and a criminal indictment against a StanChart customer. It came shortly after the Trump administration began stepping up its pressure on Iran through additional sanctions. (more…)

The seizure of British-owned oil tankers in the Strait of Hormuz is the signal that Iran’s patience has run out, due to European inaction for over a year after the US pullout from the nuclear deal, analysts told RT.

Prior to May, Iran exercised extreme restraint despite US sanctions and its frustration with Europe’s failure to offset the losses they caused, Hamed Mousavi, political science professor at the University of Tehran, said.

Eventually, Iran’s patience ran out, but not before the US “made sure that Iran has very few options remaining.”

“For a year Tehran was not doing anything and was abiding by the nuclear deal to the letter in the hopes that the Europeans would come up with a form of a mechanism… that would allow Iran to circumvent the US sanctions,” Mousavi said.

By refusing to hold back any longer, Iran wants to send a clear signal to the UK, “but especially to the Americans,” that Tehran has “the means and the power to respond to pressure and to aggression.” Iran’s actions are also a response to the US military build-up at its Middle East doorstep, Mousavi said.

Iranian journalist and Middle East expert Abbas Aslani agreed that the US withdrawal was what triggered the crisis along with the “inaction of the Europeans.”

The US might flex its military muscles in the Persian Gulf, but it’s likely not looking forward to entangling itself in a major war with Iran, especially with the US presidential election inching closer. In part, it is because Iran has convinced the US that it would never be a short, victorious war.

“What [US President Donald Trump] might be after is a short and quick attack against the country, but Iran has made sure through the channels it has that no quick war will happen if the Americans attack the country.”

Instead, the US would be looking at a long campaign that could see Iran attacking its military bases and interests in the region, the type of bog-down that can cost Trump his re-election.

Iran seized two British-operated vessels in the State of Hormuz on Friday, one of which has since been released after reportedly receiving warnings over safety and environmental issues.

The other vessel, the Stena Impero, is still in Iranian custody after being accused of maritime violations. Iran claimed that the tanker turned off its tracking device and ignored warnings before the seizure. The UK has denounced the incident as “unacceptable” but said that it hopes to resolve it through diplomacy.

The weeks-long race to succeed Theresa May is coming to a close with a new prime minister set to enter Downing Street amid continued uncertainty over Brexit.

Politics will be front and centre next week with a hearing in the US Congress featuring former special counsel Robert Mueller also on the docket. Meanwhile, investors await a rate decision from the European Central Bank and another rush of earnings from technology heavyweights Amazon, Alphabet, Facebook and others.

Here’s what to watch:

UK prime minister

Ever since Mrs May announced her intent to resign as prime minister in May, former London mayor and foreign secretary Boris Johnson has been the favourite to succeed her. Mr Johnson remains favoured in polls over current foreign secretary Jeremy Hunt to win the Conservative leadership election, the results of which will be revealed next week.

The race has Brexit implications, with parliament having failed to approve Mrs May’s agreement with the European Union on the nation’s withdrawal. Mr Johnson has argued that leaving the EU without a deal would be “vanishingly inexpensive”, keeping alive the threat of a no deal Brexit in hopes of gaining concessions from Brussels.

However, Mr Johnson suffered a setback on Thursday when British lawmakers passed a measure that would prevent the next prime minister from suspending parliament to forge ahead with a no deal Brexit on October 31.

The 160,000 members of the Conservative party have received their ballots in the leadership vote, and results are expected on July 23. Mrs May will hand over power the following day.

Robert Mueller hearing

In US political news Mr Mueller, the former special counsel in charge of an investigation into Russian interference in the 2016 presidential election, is scheduled to appear before congressional lawmakers.

Mr Mueller is expected to give testimony about his nearly two-year probe under questioning from Democrats and Republicans who have sparred over his final report, which found no collusion between the Donald Trump campaign and Russia.

The report left it to the justice department to make a determination on allegations of obstruction. The attorney general William Barr and his former deputy, Rod Rosenstein, ultimately cleared the president.

In a brief press conference in June, Mr Mueller said he would not go beyond the written report in any hearing.

The hearing, organised by the House judiciary and intelligence committees, will be held on July 24.

ECB rates

The central bank is seen as unlikely to immediately cut interest rates, but economists expect it to signal that policymakers are prepared to bring rates further below zero.

The market will also be watching if the ECB injects fresh stimulus into the eurozone economy in the form of a bond-buying programme, amid heightened global uncertainty.

“Policymakers have been dropping hints for weeks that they plan to loosen monetary policy soon, and at July’s meeting they are likely to take a step in that direction by formally changing their forward guidance. We suspect that it then won’t be long before the bank cuts interest rates and restarts [quantitative easing],” Jack Allen-Reynolds, senior Europe economist at Capital Economics, said in a note to clients.

Major central banks, including the ECB and US Federal Reserve, have taken a dovish stance in response to weak inflation, slower economic growth and trade tensions. Investors are betting that the Fed will cut its benchmark rate by at least 25 basis points at the end of the month after officials including chair Jay Powell indicated a willingness to act soon.

Corporate earnings

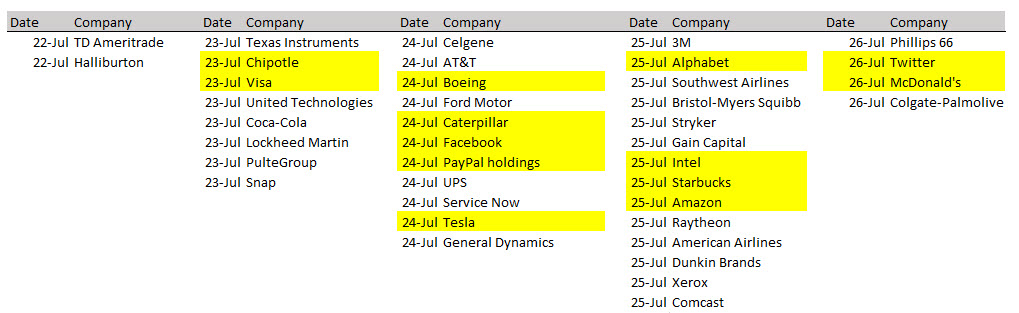

Earnings season is well underway after some of the largest US banks reported quarterly results this past week. Tech companies will headline the next barrage of earnings reports.

Amazon, Facebook, Twitter, Snap, Intel and Google parent Alphabet are due to report earnings for the most recent quarter. The calendar also includes industrial giants Boeing, Caterpillar, United Technology and Lockheed Martin, plus Tesla, Ford, Harley-Davidson, Coca-Cola, UPS and Visa.

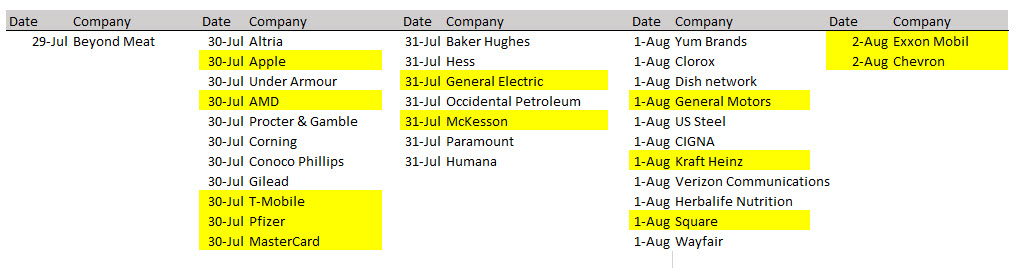

A look to the week starting July 29th, below is the schedule of some of the bigger names. The week will be highlighted by Apple on July 30.