China on Wednesday urged the Trump administration to “make up its mind” about reaching a trade deal with Beijing, warning that additional tariffs could send negotiations further off track. — South China Morning Post, July 17

We state emphatically,

Nobody Wins In A Trade War

We’re not sure how to even keep score in a trade war. The relative performance of stock markets? Economies?

Trade Deficit

President Trump likes to look at the bilateral trade deficit. However, during his tenure, the cumulative trade deficit with China has increased by almost $100 billion, 8 percent higher relative to the prior 28 months before he took office.

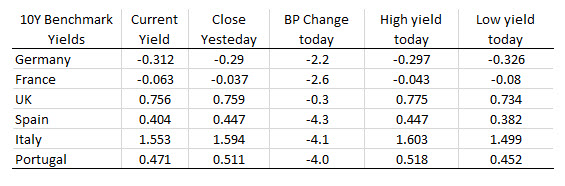

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: