Bloomberg reports

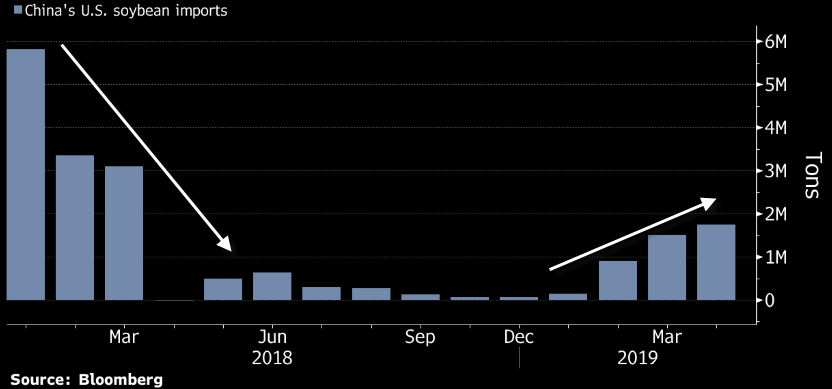

The report says that China has put purchases of American supplies on hold amid the recent escalation in the trade war between the two countries, according to people familiar with the matter. The only bright side is that China is said to have no plans to cancel previous purchases of American soybeans.

American soy sales to China had been recovering over the last few months but given the breakdown in trade talks and that both sides have reset their stance in the standoff, the act of goodwill during negotiations is likely not to continue.