While we await anything from the negotiations underway in Washington Thursday evening (and that are scheduled to continue on Friday), this via Reuters.

ICYMI, or a refresher, Reuters with a report where they cite three U.S. government sources and three private sector sources briefed on the talks:

- diplomatic cable from Beijing arrived in Washington late last week

- with systematic edits to a nearly 150-page draft trade agreement

- document was riddled with reversals by China that undermined core U.S. demands

- In each of the seven chapters of the draft trade deal, China had deleted its commitments to change laws to resolve core complaints that caused the United States to launch a trade war

There is plenty more at the piece, link is here.

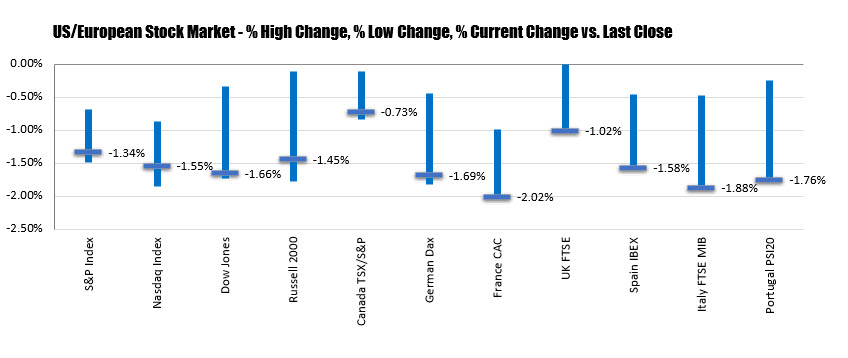

If the talks this week fail the next escalation in the trade war hits, some time in the next day or so.