Trump tweets more about US-China trade relations

The latest tweets read:

China buys MUCH less from us than we buy from them, by almost 500 Billion Dollars, so we are in a fantastic position. Make your product at home in the USA and there is no Tariff. You can also buy from a non-Tariffed country instead of China. Many companies are leaving China…..

….so that they will be more competitive for USA buyers. We are now a much bigger economy than China, and have substantially increased in size since the great 2016 Election. We are the “piggy bank” that everyone wants to raid and take advantage of. NO MORE!

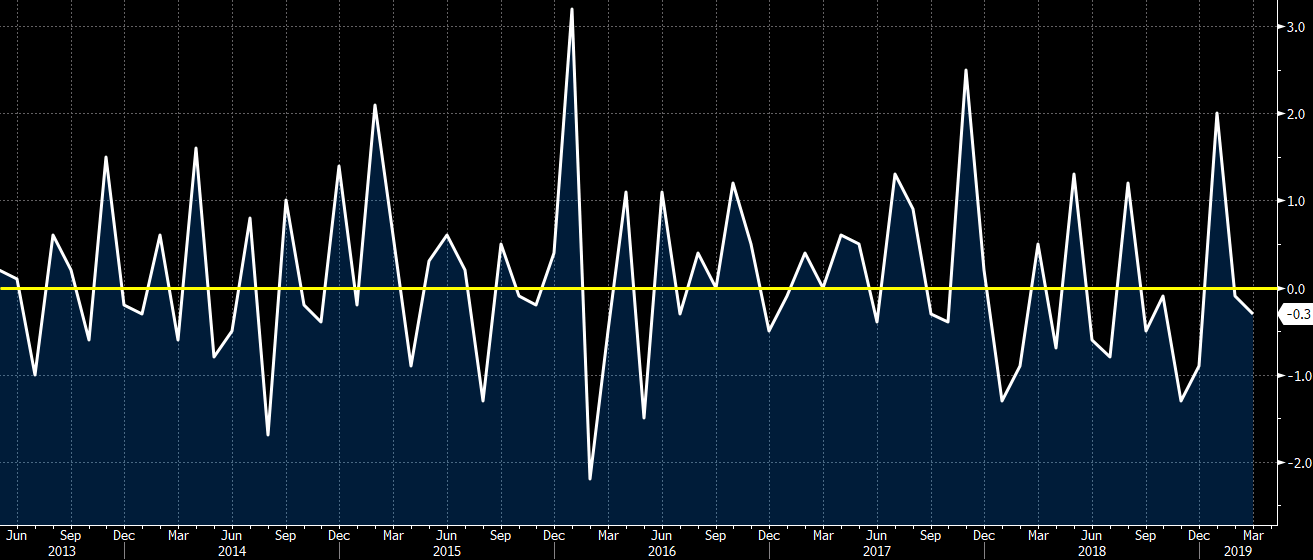

He’s right in that sense that China can’t choose to retaliate tit-for-tat in terms of tariffs but there’s other ways in which China can pursue to defend its interests. And weaponising the Chinese yuan would definitely be one of them, although they would very much like to avoid that where possible.