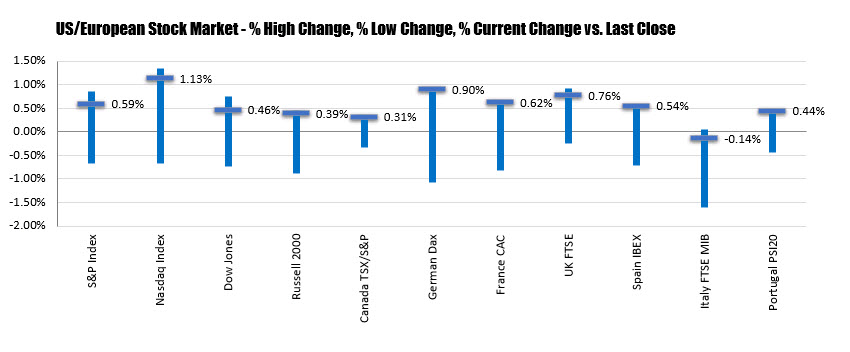

Nasdaq up over 1%. Other indices solid but more modest gains.

The major indices are closing higher with the tech heavy Nasdaq leading the way.

The final numbers are showing:

- S&P index rose 16.77 points or 0.59% at 2851.16

- Nasdaq index rose 87.654 points or 1.13% at 7822.14

- Dow rose 116.92 points or 0.46% at 25648.90

Some winners today are centered on the more high flying stocks:

- Lyft, +6.97%

- Alphabet, +4.08%

- Facebook, 3.07%

- Twitter, 2.76%

- Netflix, +2.71%

- Adobe, 1.82%

- Amazon, 1.69%

- Alibaba, 1.58%

- Microsoft, 1.41%

- Apple, +1.20%

Losers are mostly financials:

- Charles Schwab, -3.59%

- Nvidia, -1.52%

- Wells Fargo, -1.40%

- Bank of America, -1.12%

- PNC Financial, -0.82%

- Citigroup, -0.57%

- JP Morgan -0.38%

- Morgan Stanley, -0.27%