Life as a book or the book of life?

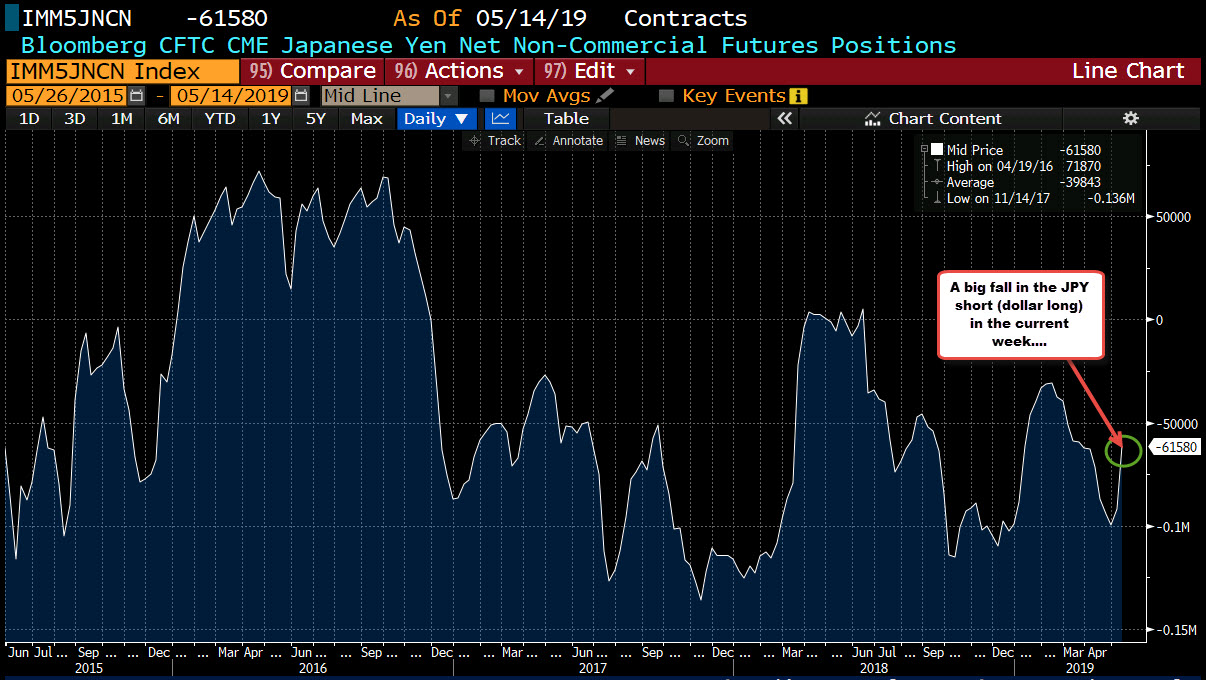

Dollar longs were trimmed in the current commitment of traders report with declines in JPY and to a lesser extent EUR leading the way. The JPY short position (USD long position) was trimmed by 30K. The EUR short (dollar long) was trimmed by 11K but remains relatively high at short 95K. The only short increase was in the AUD. The RBA is expected to mull a cut in rates at their next meeting in a few weeks.

For the week, the major indices are ending down for the 2nd week in a row: