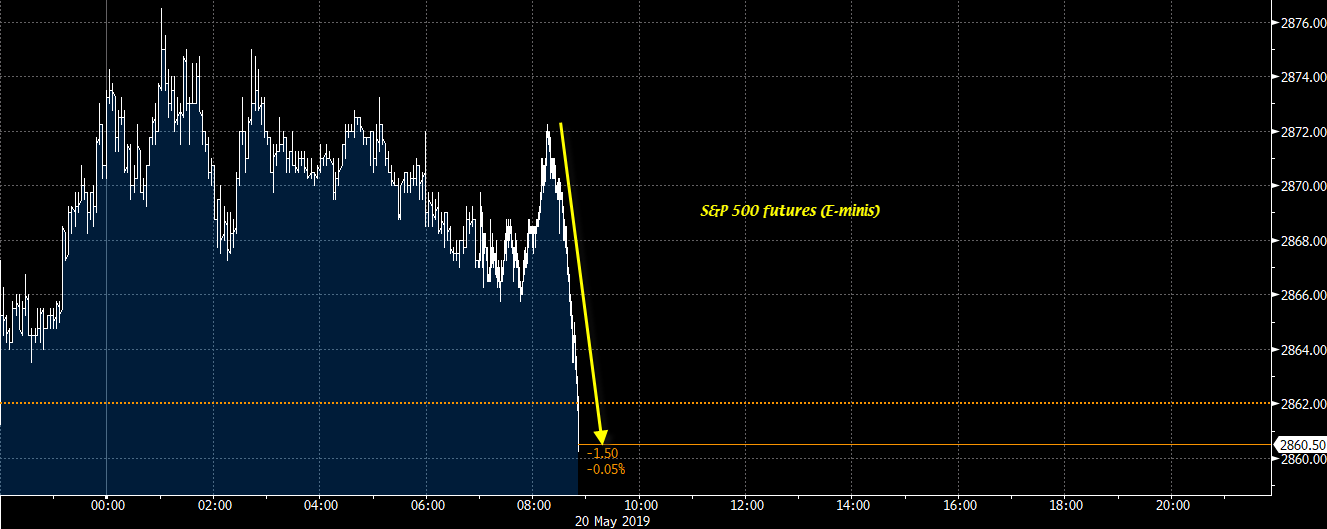

S&P 500 futures turn negative on the day

European stocks are also hitting its day’s lows after speculation earlier and that has sent USD/JPY to its lows near the 110.00 handle currently as well. The only bright side for risk sentiment is that Treasury yields have yet to really respond, as 10-year yields are still up by about 1 bps at 2.402%.

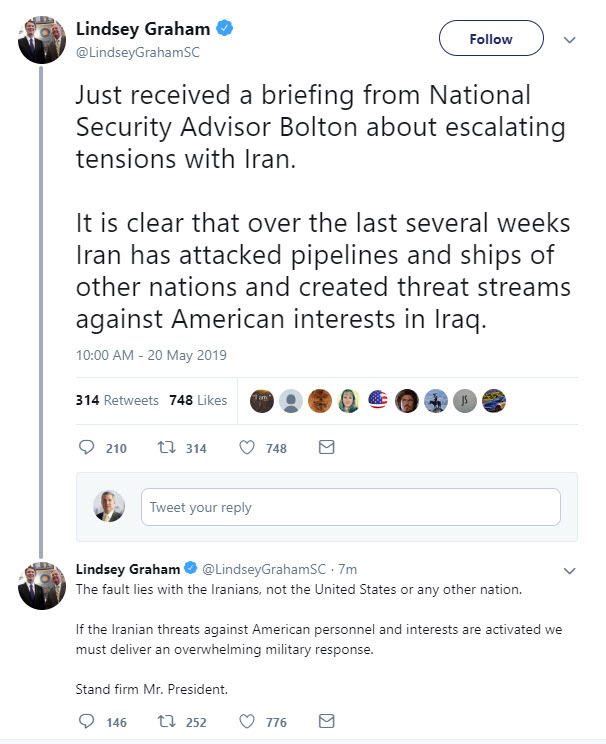

Otherwise, sentiment is starting to turn south again as US-China trade tensions continue to stick around. The speculation earlier didn’t exactly come from an official source but is enough to send jitters across markets for now.

Should the news be made official, I reckon the tremors will reverberate even more. As such, tread with caution as we’re most likely going to see trade tensions ramp up further before they get any better moving forward.