- Tendency to overvalue wagers involving a low probability of a high gain and to undervalue wagers involving a relatively high probability of low gain.

- Tendency to interpret the probability of successive independent events as additive rather than multiplicative.

- Belief that after a run of successes, a failure is mathematically inevitable, and vice versa (aka Monte Carlo fallacy).

- Perception that a favorable event has higher probability over an unfavorable event even though their mathematical probability is the same.

- Tendency to overestimate the frequency of occurrence of infrequent events and to underestimate that of comparatively frequent ones after observing a series of randomly generated events.

- Confuse the occurrence of “unusual” events with the occurrence of low-probability events (e.g. getting 13 spades is just as probable as getting any other hand).

Archives of “May 30, 2019” day

rssDifference Between Investing/Speculating vs. Betting/Gambling

- Investing – Getting an adequate return in the form of dividends, interest, or rent, while expecting safety in principal

- Trading – Making a market, trying to stay net flat and makes money by extracting the bid-ask spread

- Speculating – Buying for resale rather than for use or income, expecting capital appreciation

- Betting – Trying to be right

- Gambling – Trying to get excitement

Watch out for euro short covering in June – SocGen

Don’t be too surprised, SocGen says

Societe Generale Research discusses EUR/USD tactical outlook and sees a scope for a tactical dip below 1.11 followed by a bounce on short-covering.

“When the US economic slowdown gathers enough momentum, we will see a further inversion, a further fall in long yields around the world and a stronger yen across the board.

We might even shake EUR/USD out of its torpor and away from the pattern of tiny ranges and marginal new lows followed by tepid bounces. But that won’t happen today. If we end May with a dip below 1.11 followed by short-covering, don’t be too surprised,” SocGen notes.

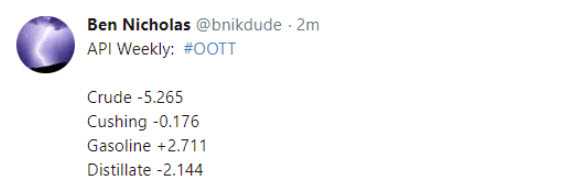

US crude oil inventories -282K vs -1360K estimate

Weekly US crude oil inventories from the DOE

- Crude oil inventories -282K vs -1360K estimate

- Gasoline inventories 2204K vs -800K estimate

- Distillates inventories -1615K versus 750K estimate

- Cushing OK crude inventories -16K vs 1266K last week

- US refinery utilization 1.30% versus 1.00% estimate

- crude oil implied demand 19202 versus 18466 last week

- gasoline implied demand 10110.4 versus 9845.4 last week

- distillates implied demand 5589.7 versus 5098.3 last week

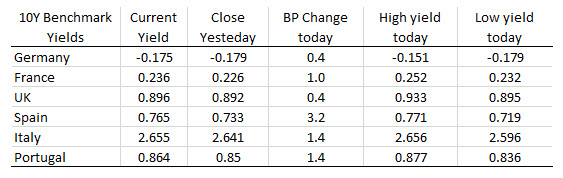

European shares end the day with mostly modest gains

Italy’s FTSE MIB the exception

- German DAX, +0.20%

- France’s CAC, +0.21%

- UK’s FTSE, +0.39%

- Spain’s Ibex, +0.66%

- Italy’s FTSE MIB, -0.20%

In the benchmark 10 year note sector, yields are higher on the day:

Watches of Switzerland shares jump on trading debut

hares in Watches of Switzerland rose as much as 17 per cent on their first day of trading after the group priced them towards the upper end of the published range.

By late morning on Thursday the stock was trading at 307p, giving the luxury time piece retailer a market capitalisation of £735m. Earlier in the day the shares rose as high as 315p.

The group set its IPO price at 270p per share, near the higher end of the 250-277p range that it had previously targeted. Brian Duffy, chief executive of Watches of Switzerland, said he was “delighted” by the reaction from investors.

Mr Duffy said that the £155m raised from selling new shares would be used, along with new banking facilities, to redeem a £265m bond. Private equity group Apollo Global Management also sold £220m worth of shares in the offering, resulting in a free float of around 34 per cent.

Watches of Switzerland has spent the past few years investing around £60m in its store estate and pushing into the US market, which Mr Duffy described as “fragmented and dominated by smaller players who cannot fund the kind of investment in stores that we can”. (more…)

Shanghai Crude Futures have fallen further and faster than Brent

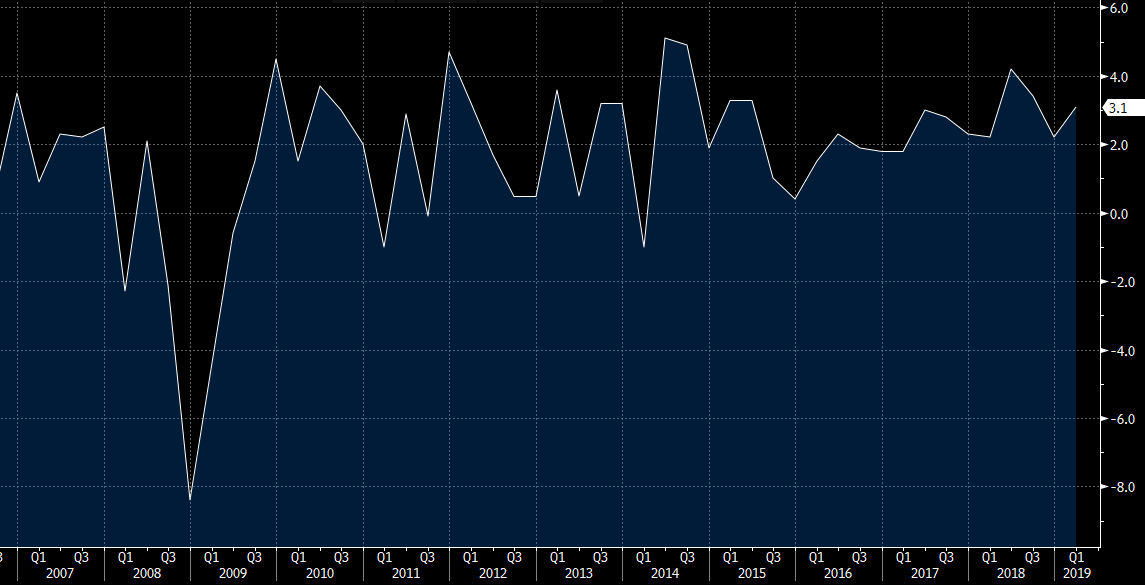

Brazilian economy suffers first contraction since 2016

Brazil’s economy shrank in the first quarter of this year, marking the first contraction since 2016 and underlining the challenge facing the government of Jair Bolsonaro.

Gross domestic product in Latin America’s largest economy fell 0.2 per cent in the March quarter compared to the previous quarter, according to the national statistics agency IBGE. The figure was in line with analysts’ forecasts and represented the first quarter-on-quarter contraction since the fourth quarter of 2016.

Compared to the first quarter of last year, the economy grew 0.5 per cent, also as expected.

“Despite hopes for a quick recovery after Jair Bolsonaro took over the presidency, the hard economic data have made for grim reading,” said analysts at Capital Economics ahead of the release of the GDP figures.

Mr Bolsonaro took power in January on an ambitious promise to revive an economy that is still reeling from a brutal two-year recession that was the worst in the country’s history.

But thus far, the rightwing president has failed to unleash the animal spirits that some had expected. The economy almost ground to a halt in the fourth quarter while monthly figures from the retail and services sectors suggest that growth slowed sharply. Consumer and business investment remain sluggish and the hoped-for fiscal reforms — particularly to the country’s bloated pensions system — have been delayed by political infighting.

The quarterly fall in output leaves the country at risk of a recession, typically defined as two consecutive quarters of contracting GDP.

Trump says US is doing well with China, promises ‘dramatic statement’ on border

Comments from Trump

US Q1 GDP (second reading) +3.1% vs +3.0% expected

- Personal consumption +1.3% vs +1.2% initially

- Q4 personal consumption was +2.5%

- Consumer spending on durables -4.6% vs -5.3% initially

- Business investment +2.3% vs +2.7% initially

- Business investment on equipment -1.0% vs +0.2% initially

- Home investment -3.5% vs -2.8% initially

- Exports +4.8% vs +3.7% initially

- Imports -2.5% vs -3.7% initially

- Net trade added 0.96 to GDP vs 1.03 pp in initial estimate

- Business inventories add 0.6 pp to GDP

- Q1 corporate profits after tax -3.5%

- GDI +1.4%

- GDP price index +0.8% vs +0.9% initially

- Core PCE q/q +1.0% vs +1.3% initially