Explaining the Iron Ore and Australian Dollar divergence

Yesterday Eamonn posted a chart highlighting the divergence between Iron Ore and the Australian dollar. They typically move in tandem, but recently that relationship has broken down. So this raises two questions. Firstly, why have they broken down and Secondly, which one will move to the other first? Will Iron Ore fall, or will the Australian dollar rise?

1. Why has the relationship between the Australian dollar and Iron Ore broken down?

Supply shocks

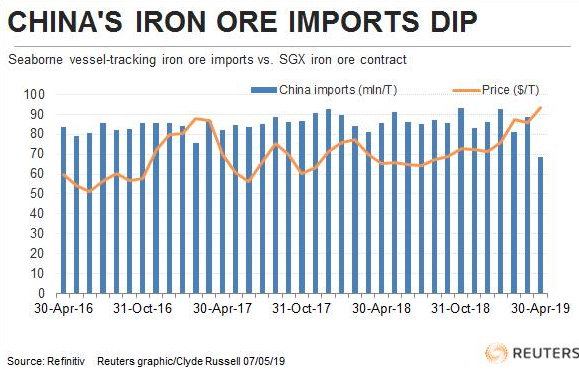

This year there have been a series of supply shocks for Iron ore. According to data compiled by Refinitiv In the first four months of 2019, Brazilian exports were 97.2 million tonnes. That is down from 111.9 million tonnes in the same period in 2018. The top mining company, Val, has been hit by a series of mine closures over safety concerns when a dam burst at the start of the year sadly killing 300 people and raising concerns over the comopanies safety practises.

Australian exports (which accounts for around 50% of global exports) had their exports down reduced from 280 million tonnes to 259 million tonnes in the first four months of the year. If you take these together then the drop from the world’s two top exporters of Iron Ore is 35.7 million tonnes. This is a significant hit to supply. On top of this imports to China are dropping too. Port inventories in China have fallen to 133.6 million in the week to May 5, down from a peak of 162 million tonnes in June last year.

2. Which will move first? Iron Ore or the Australian dollar

The concerns over Global Growth have weighed on the Australian dollar and the US-China trade war is currently at a stale mate. Trump is trapped in that he wants a trade war, but can’t go too hard at it or else he will hit US stocks. However,he will keep the pressure up.

In conclusion

In summary, the falling demand in Iron Ore will cause Iron Ore prices to fall once supply picks up. I am expecting Iron Ore prices to move back down now towards the Australian dollar.

Here is the divergence chart between the two via Bloomberg