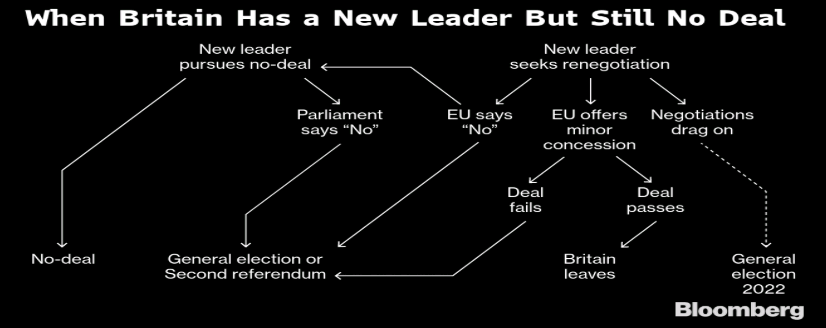

Some comments by Moody’s on the current Brexit situation

- Uncertainty around Brexit is clearly credit negative

- May’s departure amplifies the uncertainty around Brexit

The pound gained some ground earlier as May announced her resignation but quickly erased those gains with cable rising to 1.2710 before falling back to 1.2670 levels now. Amid all the chaos, what does this mean for the pound now?

In case you’re catching up on Brexit events, the situation now is that May is going to be meeting up with 1922 Committee chair, Graham Brady, later where she is expected to give a firm date on her departure.

Facebook said it took down a record 2.2bn fake accounts in the first three months of this year, only slightly less than the total number of monthly active users on the social media network, in a sign that its battle against bad actors is far from over.

The company disabled 1.2bn fake accounts in the final quarter of 2018, and 754m accounts in the quarter prior to that, according to its bi-annual report on community standards enforcement published on Thursday.

The sharp rise to 2.2bn in the latest quarter was “automated attacks by bad actors who attempt to create large volumes of accounts at one time”, Guy Rosen, Facebook’s vice-president of integrity said in a blog.

But the company added that many were taken down within minutes of registering and therefore were not included in its monthly active user count, which stands at 2.38bn.

Facebook has ramped up its security spending in an effort to better prevent abuse on the platform as well as the spread of misinformation, after evidence emerged of attempts by Russia to interfere in the US 2016 election using the network.

It now employs 30,000 security staff, many as content moderators, and has invested in developing artificial intelligence and other technologies for automatically detecting content that violates its policies. (more…)

American businesses and consumers are absorbing the bulk of the U.S. tariffs’ cost as the trade war with China drags on, expert research finds, even as President Donald Trump continues to insist otherwise.

The cost of Washington’s tariffs on Chinese imports “has been borne almost entirely” by American importers, the International Monetary Fund said in a report Thursday.

Tariffs on $200 billion worth of Chinese goods rose to 25% from 10% starting May 10. The new round covers products ranging from consumer electronics to food to clothing. Trump has also threatened higher tariffs on the remaining $300 billion in Chinese imports.

Using Bureau of Labor Statistics price data on imports from China, IMF researchers found “almost no change in the (ex-tariff) border prices of imports from China, and a sharp jump in the post-tariff import prices matching the magnitude of the tariff.” This suggests that American companies have been paying the same price, plus the duties.

Some of these tariffs have been passed on to U.S. consumers, like those on washing machines, “while others have been absorbed by importing firms through lower profit margins,” the IMF report said. “A further increase in tariffs will likely be similarly passed through to consumers.”

The Federal Reserve Bank of New York estimated Thursday an $831 cost to the typical household annually when taking into the recent 25% tariff hike into account — double the household cost posed by 2018 tariffs. (more…)