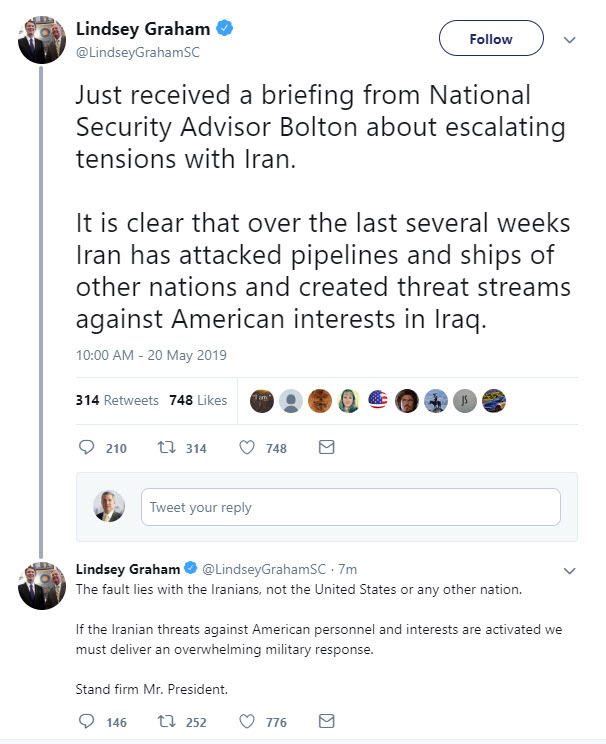

Briefing from National Security Advisor Bolton

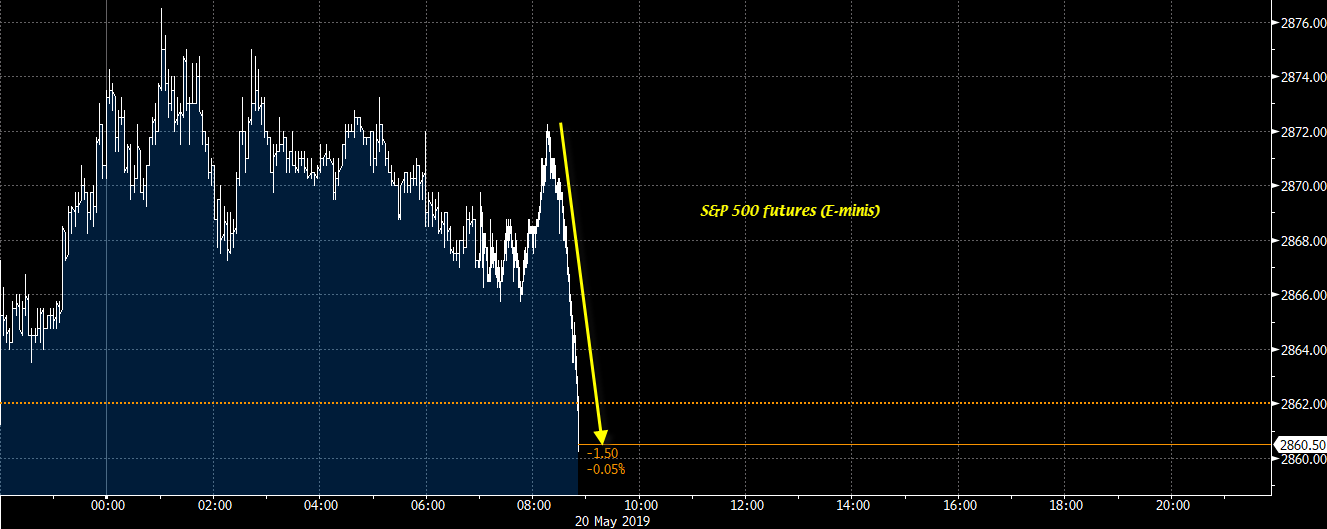

In a tweet fron So. Carolina Senator, he says that national security advisor Bolton is warning him about escalating tensions with Iran. He tweets:

Although markets are less phased by US-China tensions to start the week, let’s not forget that the situation is still far from being resolved and the Huawei case (sanctions) last week certainly doesn’t help to ease those tensions.