An important lesson in trading

Milan prosecutors have asked for four former Deutsche Bank employees and two former Nomura employees to serve prison time for their alleged role in a complex derivatives scandal at Italian bank Monte dei Paschi di Siena.

The prosecutors also asked for the seizure of about €441m from Deutsche Bank and €445m from Nomura.

Deutsche Bank declined to comment. Nomura did not immediately respond to phone calls and emails seeking comment.

The two and a half year old trial has struck at the core of European finance and is related to allegations complex derivatives deals were undertaken at what was Italy’s third-largest bank by assets to mask losses from investors.

Prosecutors also asked for eight years of prison time for former Monte Paschi chairman Giuseppe Mussari and former chief executive Antonio Vigni. They asked for six years of jail time for former finance chief Gianluca Baldessari.

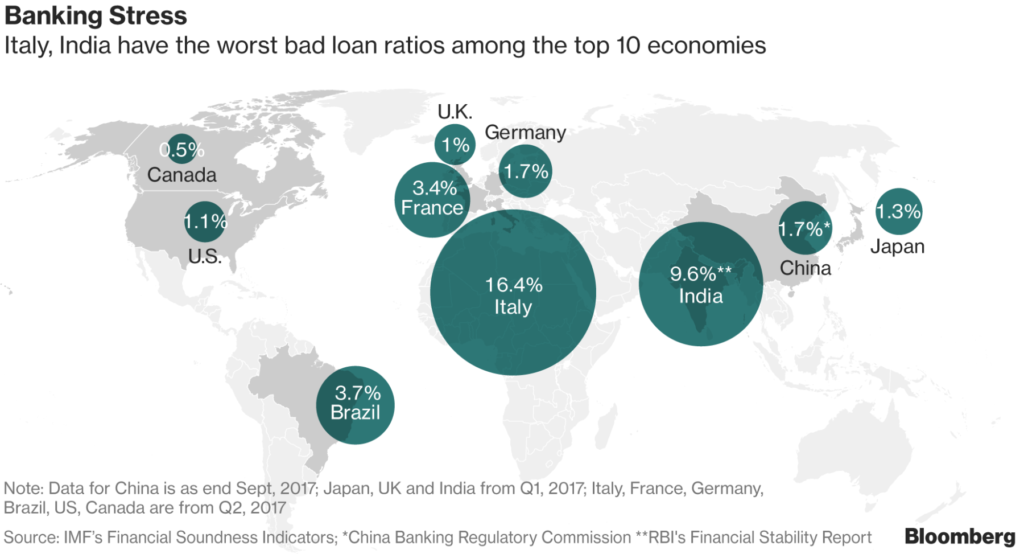

Italy took a 70 per cent stake in Monte Paschi in 2017 in a precautionary recapitalisation. The bank had failed to recover from losses incurred during Italy’s debt crisis and the triple dip recession that followed.

The three financial institutions and in total 13 former employees are standing trial over allegations of market manipulation, false accounting and misleading regulators.

The alleged crimes occurred between 2008 and 2012.

US stocks have come off marginally from high levels.

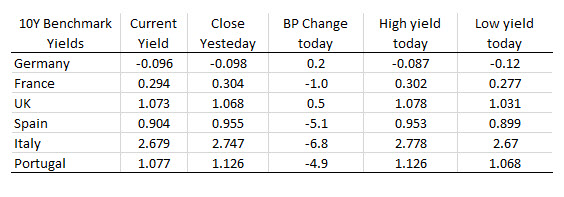

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

Berkshire Hathaway, the conglomerate controlled by billionaire investor Warren Buffett, disclosed on Wednesday its stake in Amazon was valued at $860.6m at the end of March.

Mr Buffett first revealed earlier this month that Berkshire had invested in the e-commerce giant, telling CNBC, “I’ve been a fan, and I’ve been an idiot for not buying”. Berkshire also has partnered with Amazon and JPMorgan Chase on a joint healthcare venture called Haven.

Berkshire held 483,300 Amazon shares as of the close of the first quarter, according to a 13F filing with the US Securities and Exchange Commission. It amounts to a stake of roughly 0.1 per cent in the company. Based on Amazon’s share price on Wednesday, the same investment would currently be worth $904m.

The filing also revealed that Berkshire raised its holdings in JPMorgan, Delta Air Lines and Red Hat while cutting stakes in Wells Fargo, Phillips 66, Southwest Airlines and Charter Communications.

The group’s stake in Apple remained at 249.6m shares, or 5.4 per cent, and was worth $47.4bn, its single largest investment.

Berkshire bumped up its stake in JPMorgan by 18.8 per cent to 59.5m shares, which were valued at $6bn. It owns 1.8 per cent of the bank’s shares.

Its stake in Wells Fargo, the US bank beset by scandals, narrowed by 4 per cent to 409.8m shares worth $19.8bn. Berkshire, which owns 9.1 per cent of shares, is Wells Fargo’s top shareholder.

Berkshire’s 13F filing is closely watched by investors seeking insights into the investment philosophies of Buffett and his portfolio managers Todd Combs and Ted Weschler.

Shares in Amazon were up 0.2 per cent in after-hours trading.