What we do know is the ceiling stalled the rally, and the bullish control weakened

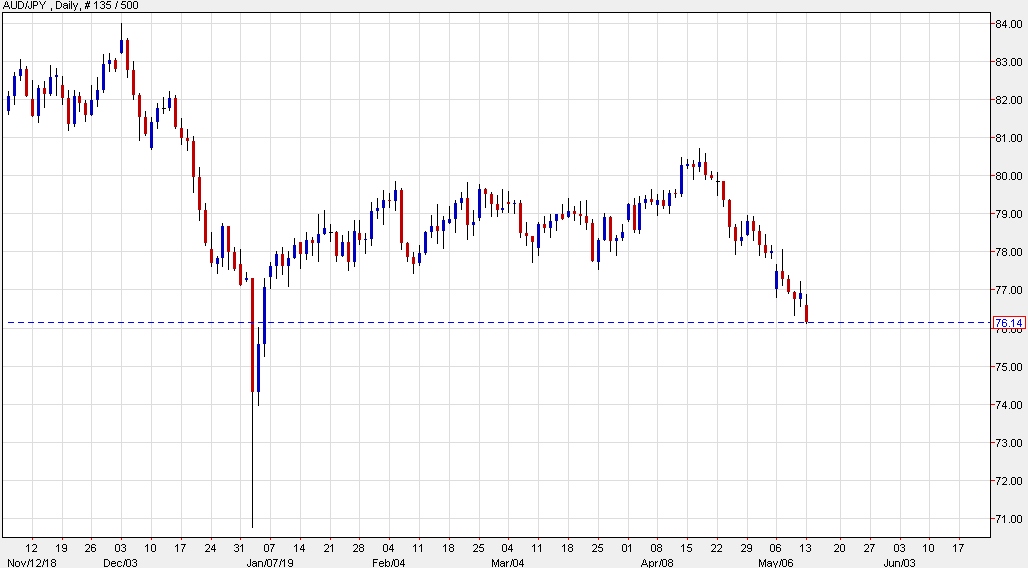

Technically, there isn’t a lot to prevent this pair from sinking all the way back down to the January low. There is some scope for Australian firms to take Chinese market share away from the US but softer global growth will be a huge headwind if this trade battle continues.

A softer close for the Nikkei here as equities sentiment in Asia is very much affected by the weaker performance seen in US equity futures. E-minis are down by more than 1% to start the day and that’s leaving a bit of a softer risk mood in trading so far.

Three consecutive close below 2.533 +weekly close will take to 2.4375-2.40

More to our Members.

#SSEC#Shanghaicomposite

Watch 2811 level……CRUCIAL Support or last Hope !

Break and close below for 3 consecutive days will take to 2652-2599 in panic.

Hurdle now at 2975. Crossover and close will take to 3058-3085++

More to our Members pic.twitter.com/UdlFwyoyx9— Dr.Anirudh Sethi ,PhD (@Iamanirudhsethi) May 13, 2019