he week was not great though

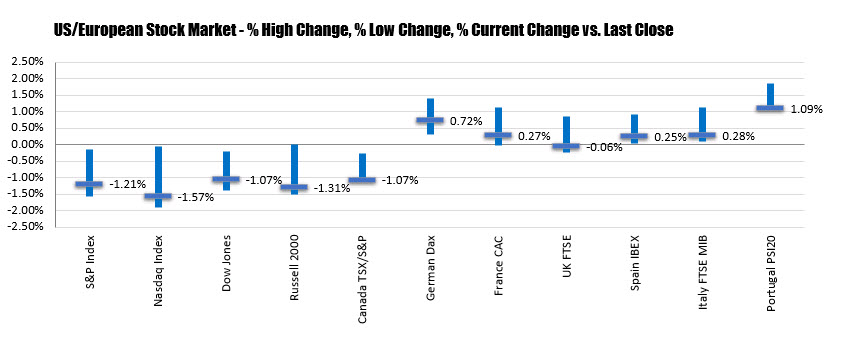

For the week, the numbers were not impressive:

- German Dax, -2.84%%

- France’s CAC -3.99%

- Britains FTSE, -2.01%

- Spain’s Ibex, -3.10%

- Italy’s FTSE MIB -4.08%

- S&P index, -3.64%

- Nasdaq, -4.51%

- Dow, -3.54%

For the week, the numbers were not impressive:

They’re certainly keeping their bullets close to the chest for the time being but you can argue that there has been a subtle change to their approach to trade talks than in the past. Previously, China has never really weakened the yuan in the build-up to negotiations but today, the PBOC noticeably settled on a higher USD/CNY at the fixing this morning.

The Nikkei closes lower but bounced off its lows in the last hour of trading as Chinese stocks also recouped losses seen immediately after the lunch break earlier. At one stage, the Nikkei was down by nearly 1% as US increased tariffs on $200 billion worth of Chinese goods and as China vowed to retaliate.

However, this does not mean the end of a possible trade truce between the two countries. Both parties are still scheduled to talk things over later today and we’re yet to hear of any news about the Trump-Xi phone call, if it even happens.

Uber priced its shares at $45 a piece, near the bottom of its indicated $44-to-$50 range, after paring expectations following the fraught debut of its US rival Lyft and a broader US markets sell-off.

The ride-hailing company sold 180m shares to raise $8.1bn in new capital and deliver a total valuation of $82.2bn on a fully diluted basis. This makes it the biggest IPO for a US-based technology company since Facebook in 2012, and the tenth biggest overall US listing in terms of proceeds, according to Dealogic.

The stock will begin trading on the New York Stock Exchange on Friday under the ticker UBER. The lead underwriters on the IPO were Morgan Stanley, Goldman Sachs and Bank of America.

Despite its rapid rise to become one of the biggest global ride-hailing companies, Uber’s valuation has not increased as spectacularly as some early backers hoped. It is selling shares to public investors below the $48.77 price at which it sold stock to private investors including Saudi Arabia’s Public Investment Fund three years ago.

Excluding the new funds raised and a $500m private stock sale to PayPal at the IPO price, Uber’s IPO valuation of $73.6bn fell below the $76bn reached in its last private fundraising in August.

Before it launched its IPO roadshow, Uber had told some holders of its convertible notes that it could price in a range of $48 to $55 a share, giving it a valuation of $90bn to $100bn.

“There is investor demand for these types of businesses that are innovators and creating new economies that are changing the way we drive and changing the way we exchange ideas, but not euphoria,” said Jordan Stuart, client portfolio manager from the Federated Kaufmann funds.

Mr Stuart said that investors are interested in profits alongside disruptive technology and revenue growth. “The market is being very deliberate,” he said. “Investors are looking for a pathway to profitability.”

Uber decided to take a more conservative approach to pricing in the last few days as it wrapped up two weeks of investor meetings in New York, London, San Francisco and other cities, according to a person familiar with the roadshow.

Executives and bankers were keen to avoid a sell-off like Lyft has seen in its early weeks of public trading. Uber prioritised the allocation of shares to institutional investors and “blue-chip” funds that were seen as more likely to hold the stock for the long-term, rather than hedge funds or retail investors, the person said.

Lyft, which only operates in the US and Canada, debuted in March with an offering that raised $2.3bn and valued the company at $24bn. Since then, its shares have traded well below their IPO price of $72 as investors grow concerned about the lack of profits in the ride-hailing industry and pressure from short sellers. Lyft shares closed on Thursday at $55.18.

“The Uber team is playing a long game here in their pricing strategy,” said Eric Kim, co-founder and managing partner at Goodwater Capital. “They are trying to get the right shareholders who will be with them for the long term, so they are pricing shares more attractively.”

“Given how much negative sentiment there is right now in the overall ride-sharing space that we see in the performance of Lyft stock, the market will reward Uber for being measured in its pricing strategy.”

Even with the more conservative pricing, Uber’s co-founders and early investors are set for a bonanza.

Vale, the world’s biggest producer of the steelmaking ingredient iron ore, on Thursday posted a $1.6bn loss in the first quarter of the year as the company reels from a deadly dam disaster that killed over 230 people.

The loss was driven by $4.5bn in “expenses related” to the dam disaster in Brumadinho in the Brazilian state of Minas Gerais, including provisions for a compensation programme and the decommissioning of tailings dams, and $450m related to “operational stoppages”.

Quarterly revenue fell to $8.2bn in the three months to the end of March from $8.6bn in the same period a year ago on lower sales as a result of some of its operations going offline after the disaster.

The deadly dam breach also led to a $652m loss before tax, depreciation and amortisation — Vale’s first ever negative quarterly Ebitda result. During the same period last year, the company reported $3.9bn in adjusted Ebitda.

The Rio de Janeiro-based company has been dealing with the worst crisis in its history since late January when a tailings dam collapsed leaving a swath of destruction that killed 237 people, displaced hundreds more and triggered an outpouring of public anger against Vale. This resulted in the departure of former chief executive Fabio Schvartsman.

On Thursday, Eduardo Bartolomeo, who replaced him, said he was “committed to leading Vale through the most challenging moment in its history”.

Kim’s new Tinder pal.

Kim’s new Tinder pal.