The richest 10% are responsible for HALF the world’s carbon emissions.

*APPLE SEES 3Q REV. $52.5B TO $54.5B, EST. $52.22B *APPLE TO BUY BACK UP TO ADDED $75 BILLION IN SHARES *APPLE 2Q EPS $2.46, EST. $2.37 *APPLE 2Q REV. $58B, EST. $57.49B *APPLE 2Q IPHONE REVENUE $31.05B, EST. $30.50B *APPLE 2Q SERVICE REV. $11.45B

A Democratic commissioner at the Securities and Exchange Commission has objected to the regulator’s latest settlement with Elon Musk.

Robert Jackson, the lone Democrat at the SEC, issued a dissenting statement on Tuesday evening after a judge in New York approved a deal that resolved a dispute about the Tesla chief executive’s tweets.

The SEC had accused Mr Musk in February of violating a settlement last year that required him to get pre-approval from a Tesla lawyer for material tweets about the company. The new agreement outlined specific sorts of information that required advance approval.

Mr Musk has denied breaking the initial settlement, and the judge overseeing the case did not make a ruling on the question.

“Given Mr. Musk’s conduct, I cannot support a settlement in which he does not admit what is crystal clear to anyone who has followed this bizarre series of events: Mr. Musk breached the agreement he made last year with the Commission—and with American investors,” said Mr Jackson.

The comment was a rare dissent at an agency that has been relatively united, at least in public, on enforcement actions under the chairmanship of Jay Clayton, who was appointed by Donald Trump in 2017.

Two Republican commissioner had privately objected to parts of the initial settlement with Mr Musk last year, the Financial Times previously reported.

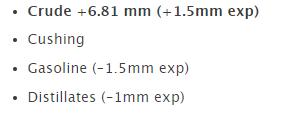

BoA / ML forecast

Bank of America / Merrill Lynch characterise the +250K expectation as “strong job growth”. Fair enough.

It does look like a lot of fun was had TBH.

It does look like a lot of fun was had TBH.

April may be the cruelest month according to TS Eliot, but investors in US banks are likely to disagree.

The S&P 500 financial sector advanced 8.8 per cent in April and led the gain on the benchmark index, which powered to all time peaks this month.

That marked the biggest one-month gain for financials since November 2016, when it jumped more than 13 per cent after Donald Trump’s election win that spurred hopes for deregulation, tax reform and expectations stimulus plans would stoke inflation and drive up interest rates.

The last time financials were the biggest gainer on the benchmark S&P 500 was June 2017.

Moreover, the broader KBW bank index, one of the most tracked sector benchmarks which follows 24 stocks, was up 8.9 per cent for the month.

The rally in bank stocks comes after a solid first-quarter earnings season — with retail business outperforming while investment banking and capital markets operations stumbled.

Three quarters of financials posted stronger than expected first-quarter earnings and 54 per cent logged better than expected revenues, according to data provider FactSet.

Notably, the advance comes despite the dovish stance adopted by the Federal Reserve at its monetary policy meeting in March, when it ditched plans for rate rises this year.

Higher rates are often a boon to banks’ net interest margins, a crucial measure of profitability, as the difference between what banks charge borrowers and what banks pay for funding widens.

Moreover, the yield curve, measuring the spread between short- and long-term borrowing costs, has flattened this year, which is considered by some to be an indicator of an economic slowdown and when combined with rising credit costs and declining trading revenues, some analysts are unsure of how long the financial rally will last.

With April’s surge, financials are up 17.4 per cent year-to-date, following a 14.7 per cent decline last year.

The S&P 500 squeaked out a fresh record high on Tuesday, overcoming a cautious mood among investors after underwhelming results from Google parent Alphabet.

The benchmark index, which fell as much as 0.6 per cent early in the session, notched a 0.1 per cent gain to settle at 2,945.83, a new closing high. The S&P ended the month with a 3.9 per cent gain, its best showing since January and its strongest April rally in a decade.

The Nasdaq Composite dropped 0.7 per cent, retreating from its own record high with Alphabet’s 7.5 per cent slide weighing on the tech-heavy gauge.

The mixed results came amid upbeat results from GE and McDonald’s, whose shares were up 4.6 per cent and 0.3 per cent respectively.

Alongside the latest batch of corporate earnings, investors also have their eyes peeled for updates on US-China trade talks. Treasury secretary Steven Mnuchin said on Tuesday negotiations between the two sides are in “the final laps” and that he hopes to make “substantial progress”.

Across the Atlantic, the euro picked up on Tuesday after stronger-than-expected growth data for the currency area’s first quarter and robust inflation data from Germany.

Confirmation that Italy’s economy returned to growth in the period helped the trend, and Milan’s FTSE MIB rose 0.4 per cent, outrunning a trend for flat stock indices across Europe.

As the data helped ease the worst of investors’ concerns about the currency area’s lacklustre economy, the euro turned positive for the day to rise 0.3 per cent overall, reaching $1.1215, a four-session high. The turnround trimmed the shared currency’s 2019 decline to just over 2 per cent. The dollar index was 0.3 per cent lower, pulling back further from the near two-year peak reached last Friday.

Frankfurt’s Xetra Dax 30 shed earlier losses to gain 0.1 per cent, while the Europe-wide Stoxx 600 recovered to climb fractionally higher. London’s FTSE 100 was down 0.3 per cent.

Asian trade tracked data from China’s manufacturing sector which showed slower expansion than economists expected in April, according to government and private sector gauges released on Tuesday. Hong Kong’s Hang Seng fell 0.7 per cent, while the mainland’s CSI 300 was muted, ticking up 0.3 per cent.