Further positive commentary for oil if nothing else

- Keen to keep prices stable and oil markets well supplied

- Will monitor markets to assess the needs at the next OPEC meeting

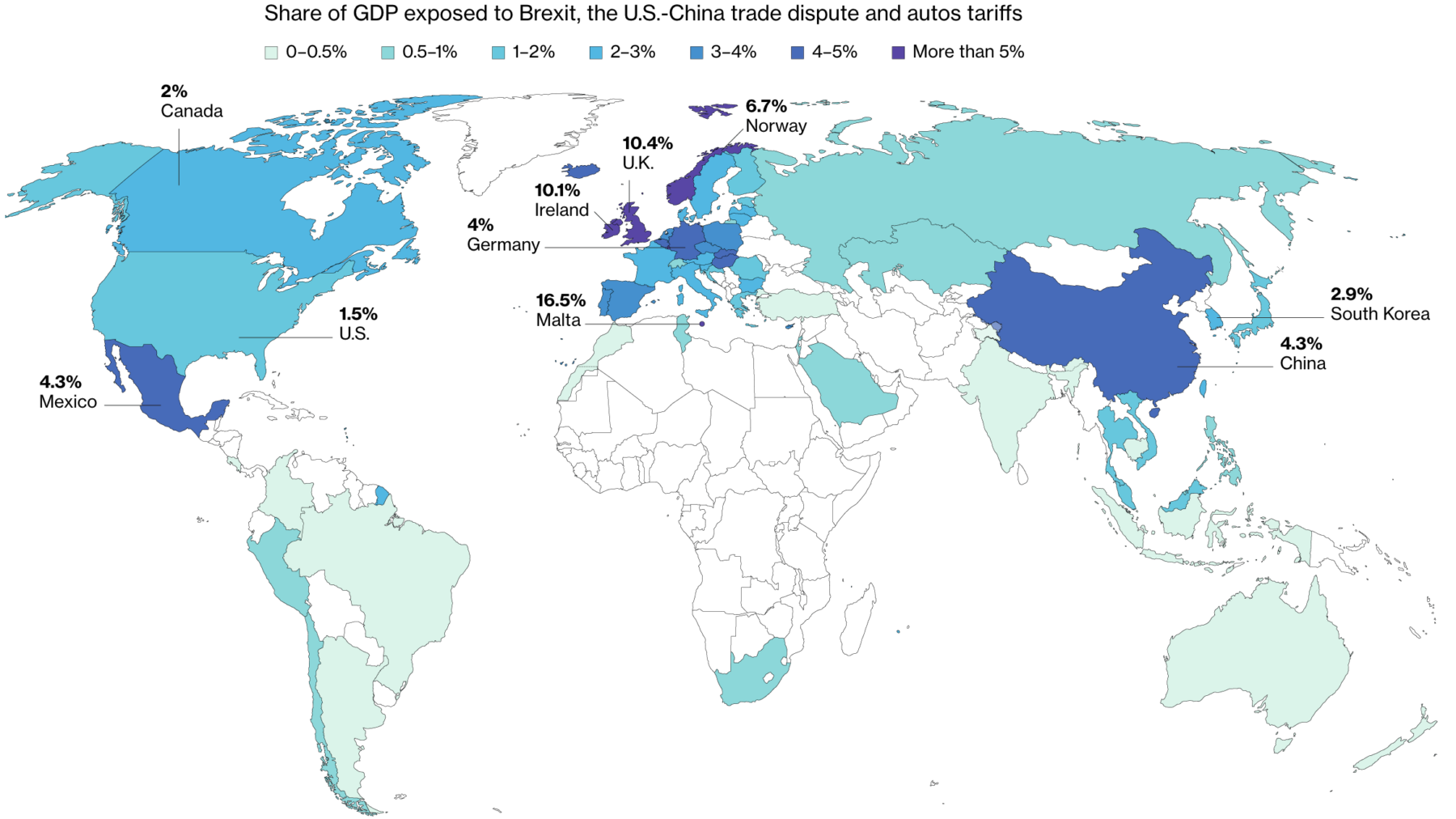

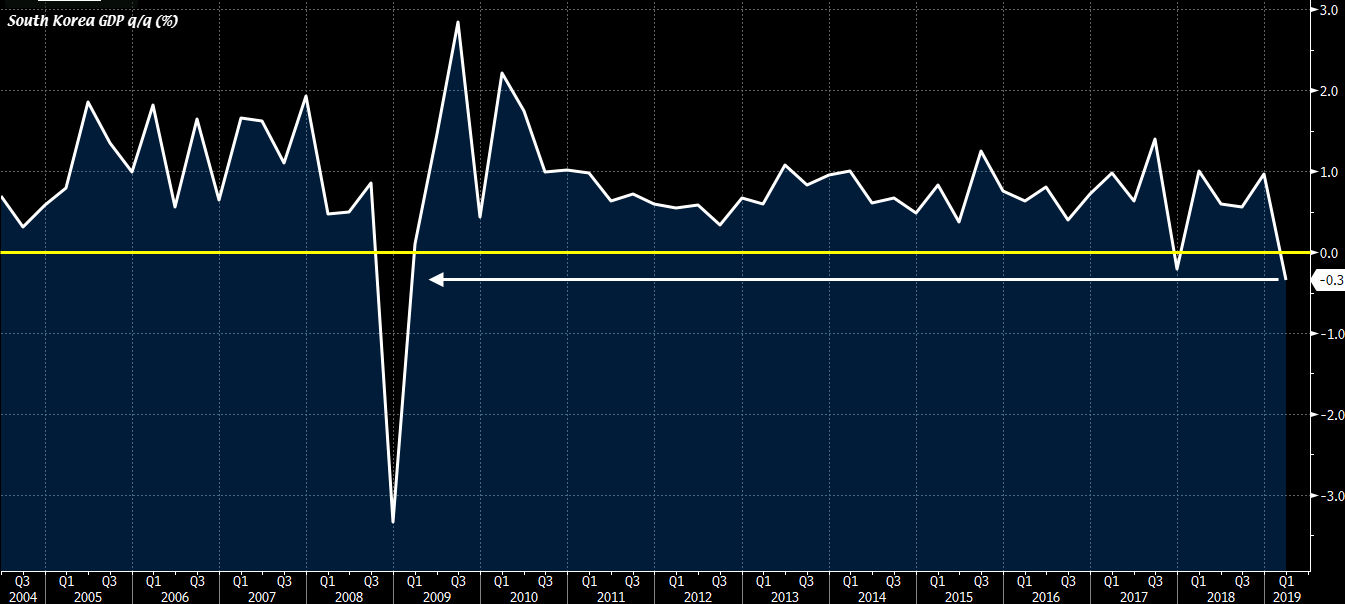

Japanese stocks are seeing decent gains on the day despite a weaker close in Wall Street in trading overnight as investors are gearing towards the 10-day break after the end of this week. Other Asian equities are generally more subdued with the Shanghai Composite down by 1% and the Kospi down by 0.4% as global economic conditions remain questionable after South Korea Q1 GDP contracts, slowing to its weakest pace since the global financial crisis.

The Bank of Japan has promised not to raise interest rates before spring 2020 as it made a series of tweaks to its massive programme of monetary stimulus.

It is the first time Japan’s central bank has put a date on the “extended period” for which it intends to keep rates low, mirroring a policy first used by the US Federal Reserve in 2011. A specific date gives markets greater certainty but with almost nobody expecting a rate rise during the next year, it is unlikely to make a substantial difference to the economy.

The BoJ’s decision, however, shows it is concerned about slowing growth and the lack of progress towards its 2 per cent inflation objective. The underwhelming scale of the action may only add to the perception that it has run out of ideas and tools for stimulus.

Two doves on the BoJ policy board, Yutaka Harada and Goushi Kataoka, voted against the move because it did not send a strong enough signal of the central bank’s commitment to reaching its inflation objective.

“The Bank intends to maintain the current extremely low levels of short- and long-term interest rates for an extended period of time, at least through around spring 2020, taking into account uncertainties regarding economic activity and prices,” the central bank said in a statement. (more…)

GDP (sa) -0.3% q/q (expected +0.3% q/q)

+1.8 % for the y/y (vs. expected of +2.5%)

Private consumption (sa) +0.1% q/q

Construction investment (sa) -0.1 % q/q

Facility investment (sa) -10.8% q/q

Its not surprising growth is slow in Korea (well, negative q/q), what with the trade wars and such. But, yeah, these are horrible numbers.

“Well, someone farted!”

“Well, someone farted!”