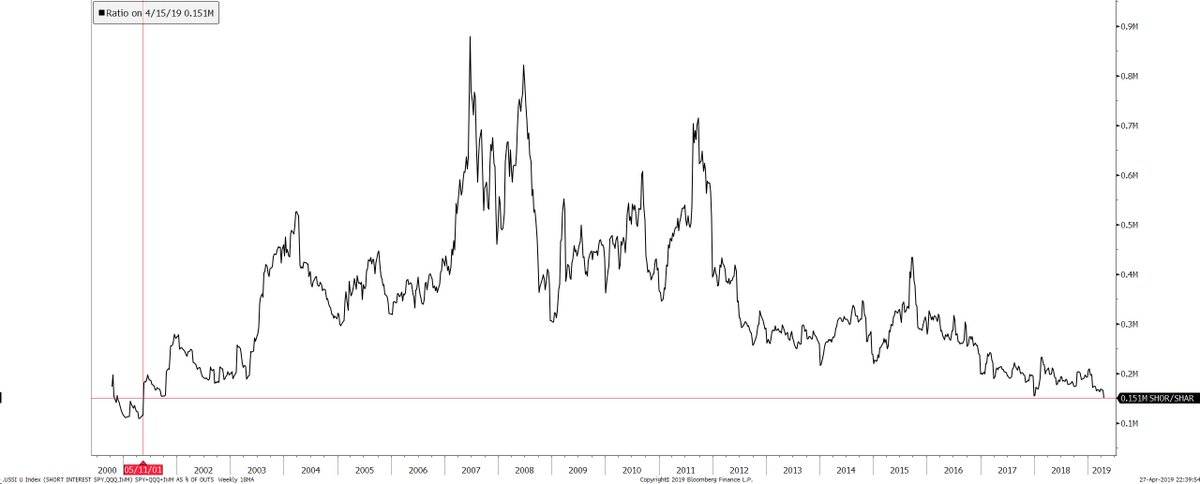

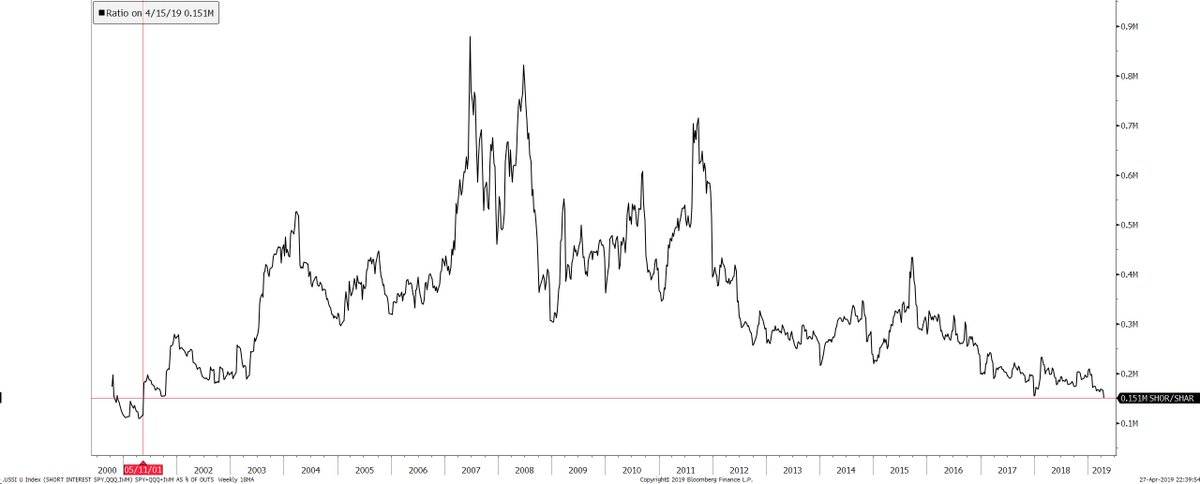

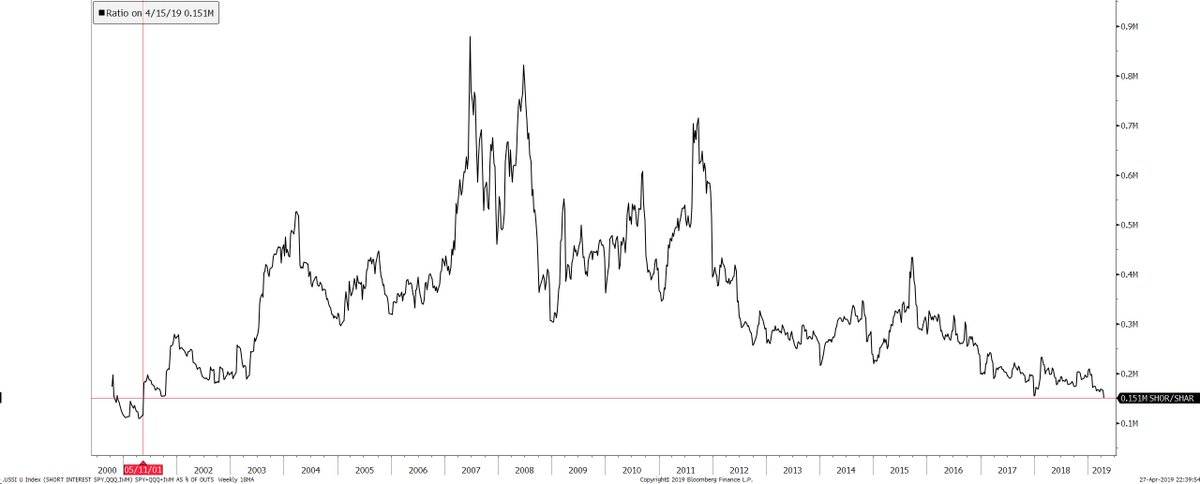

Short Interest as a proportion of outstanding ( $SPY + $QQQ + $IWM)

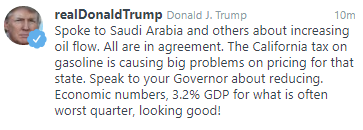

The major indices are all closing higher with the Nasdaq and the S&P closing at record levels.

Some winners today

1. A good trade is taken with complete confidence, and follows your trading method. A bad trade is taken on an opinion.

2. A good trade is taken with a disciplined entry and position size. A bad trade is taken to win back losses the market owes you.

3. A good trade is taken when your entry parameters line up. A bad trade is taken out of fear of missing a move.

4. A good trade is taken to be profitable in the context of your trading plan. A bad trade is taken out of greed.

5. A good trade is taken according to your trading plan. A bad trade is taken to inflate the ego.

6. A good trade is taken without regret or internal conflict. A bad trade is taken when a trader is double-minded.

Here is a look at the DAX as the recovery continues: