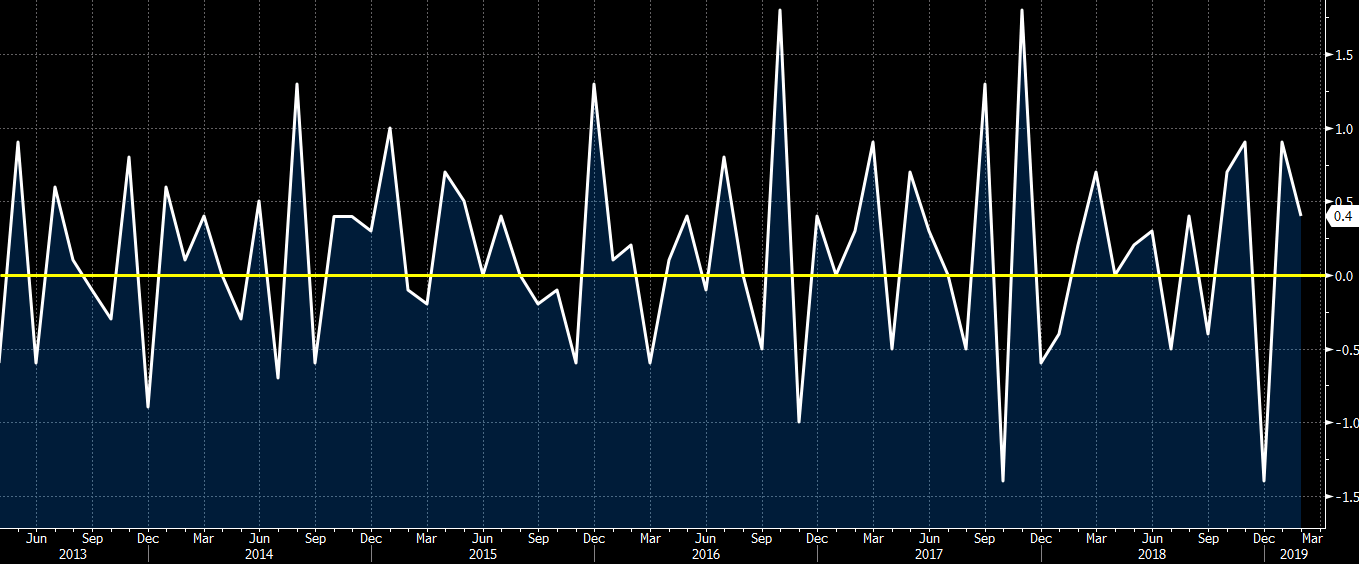

The S&P 500 advanced 0.2 per cent to close at its highest level since October 9, helped by a strong lead-in from European equities. The Wall Street benchmark had gained as much as 0.6 per cent during the session but trimmed those gains — briefly turning negative in the final hour of trading — as disappointing data on the US services sector damped sentiment.

The rally was particularly kind to chipmakers. Advanced Micro Devices led the way with an 8.5 per cent gain, while the Philadelphia Semiconductor Index hit a record high, amid hopes a trade truce with China would buoy chip demand.

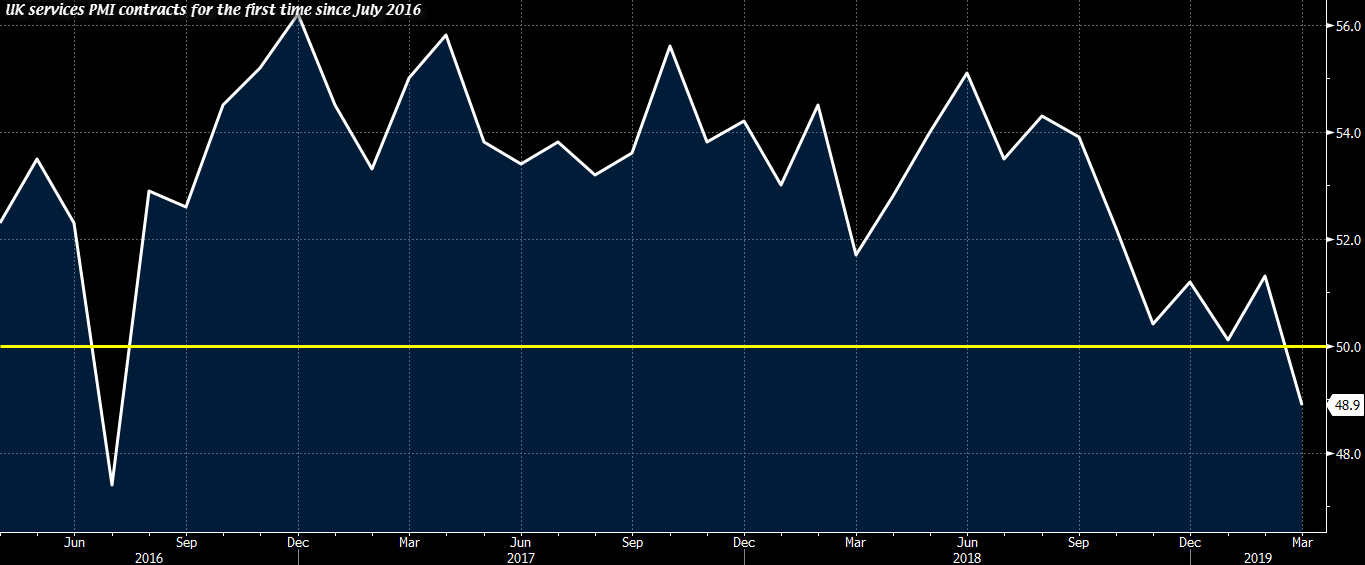

In Europe, the continent-wide Stoxx 600 added 1 per cent and reached its highest level since late August. Frankfurt’s Xetra Dax 30 gained 1.7 per cent. London’s FTSE 100 was up by a more mild 0.4 per cent.

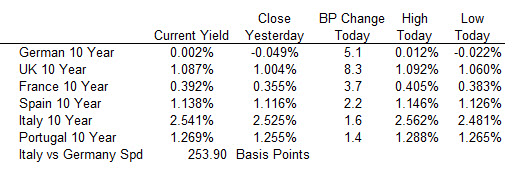

The yield on 10-year US Treasuries crossed back up over 2.5 per cent as the improving sentiment toward growth drew investors out of the debt. It rose 4.1 basis points to 2.5205 per cent.

Brent crude neared $70 a barrel earlier in the session and towards a new high for 2019 on signs of falls in Opec production and growing confidence in the outlook for global growth. But in US trade it gave up some ground, settling 0.1 per cent lower at $69.31 a barrel.

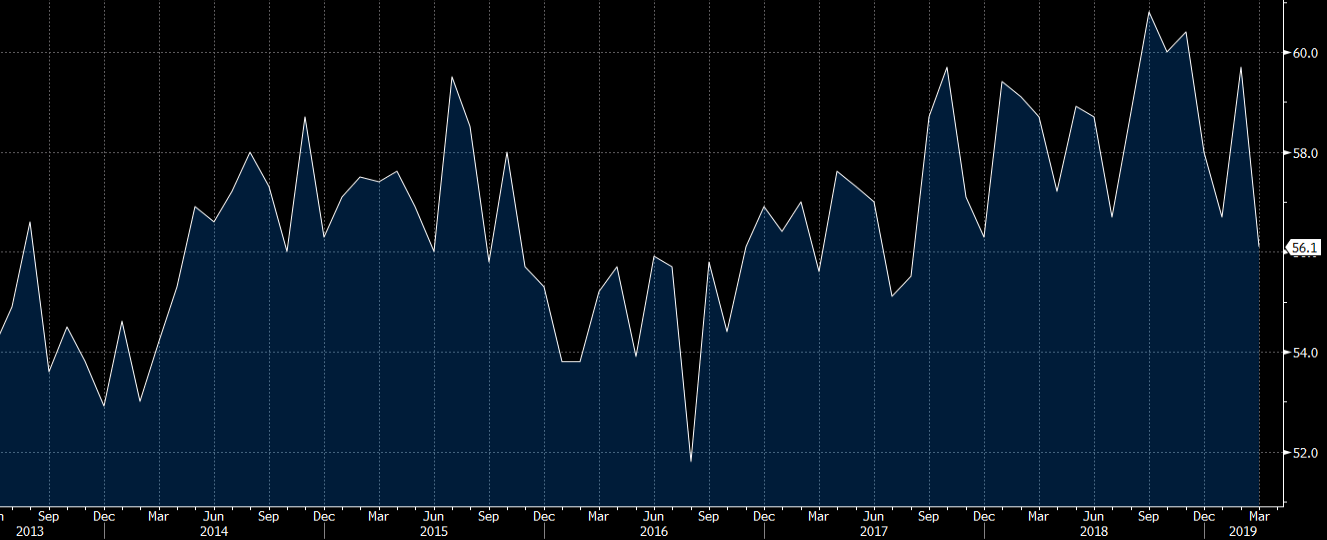

Mainland China’s CSI 300 added 1.2 per cent, a one-year high. The gains for Chinese equities also come as a survey of China’s service sector found activity rose to a 14-month high in March, echoing improvements in the manufacturing sector.

Larry Kudlow, the director of the White House National Economic Council, said he expected “additional headway” would be made in talks that resumed in Washington on Wednesday