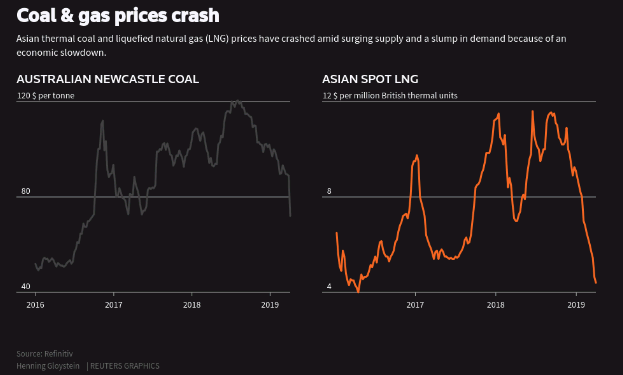

Australia’s thermal coal prices plunged this week, set for its biggest weekly fall since the 2008/09 global financial crisis

While most markets remained steady this week, something awry is brewing in the commodities space as coal prices for prompt loading at Australia’s Newcastle port have lost almost 20% this week – falling to its lowest since May 2017 to under $80 per tonne now.

You can scratch this off as an isolated incident if it were just coal alone, but Asian spot LNG (liquefied natural gas) prices are also seeing a plunge of more than 60% from its peak towards the end of 2018. For some context, LNG is coal’s most direct competitor as a power generation fuel so there’s gotta be something amiss here.

There’s always the case that seasonal demand is waning because we have passed the winter months but traders are also noting that slowdown in industrial activity across the globe is contributing to the decline in prices here as demand has plunged rapidly.

When a global recession hits, there’s always red flags pointing towards the beginning of them. This may be a nothing but given the way economic conditions are developing as of late, I would say it’s too early to discount the fact that this is potentially mounting evidence that markets are fearing one is just over the horizon.