Thought For A Day

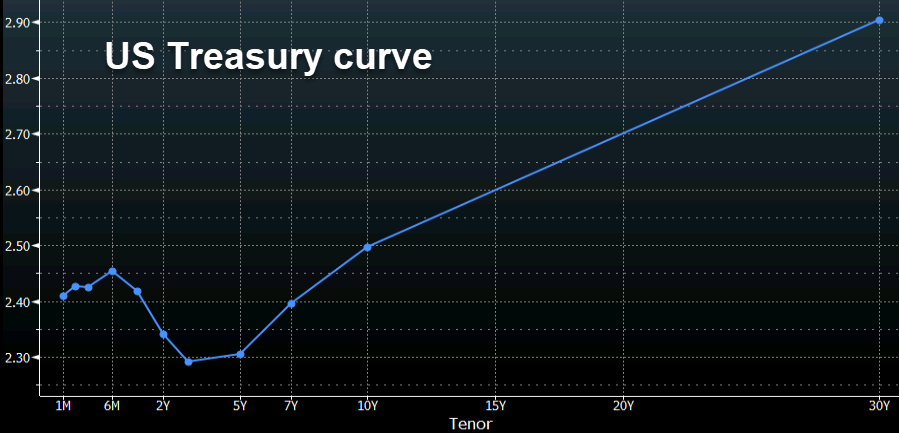

1) Typically, an inverted yield curve would indicate that monetary conditions have tightened significantly. Real rates would be elevated and the availability of credit would start worsening, with widening credit spreads and deteriorating bank lending surveys. This time around the key indicators of monetary conditions do not appear tight, despite the inversion. Current real rates are near zero, when they averaged 3% at the point of the past 6 inversions. HY credit spreads are only 80bp off the cycle lows, when they are usually 300-400bp wider ahead of the economic downturns. Banks are very well capitalized currently, having deleveraged over the past 10 years, and stand ready to keep extending credit.2) The curve inversion might be saying more about the global growth decoupling and the desynchronized nature of monetary policy, rather than be an ominous sign for future US growth. The current spread between the US and German 10 year bond yield at 250bp isat the 30 year highs, which could be anchoring long US yields to some extent.3) Finally, as the term premia is outright negative the current inverted curve might be saying more about subdued inflation expectations than about growth prospects. This is where some repricing could materialize, especially if our repeat-of-2016 call gains further traction. We stay constructive on equities given the China turn, dovish Fed, potential USD peak, pivot away from trade uncertainty and likely bottoming out in inflation expectations.

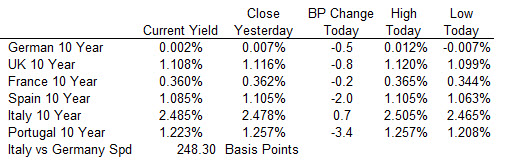

The 10 year benchmark yields are mostly lower with the Italian yields bucking the trend (+0.7 bps). Below is a review of the highs and lows and change for the day.

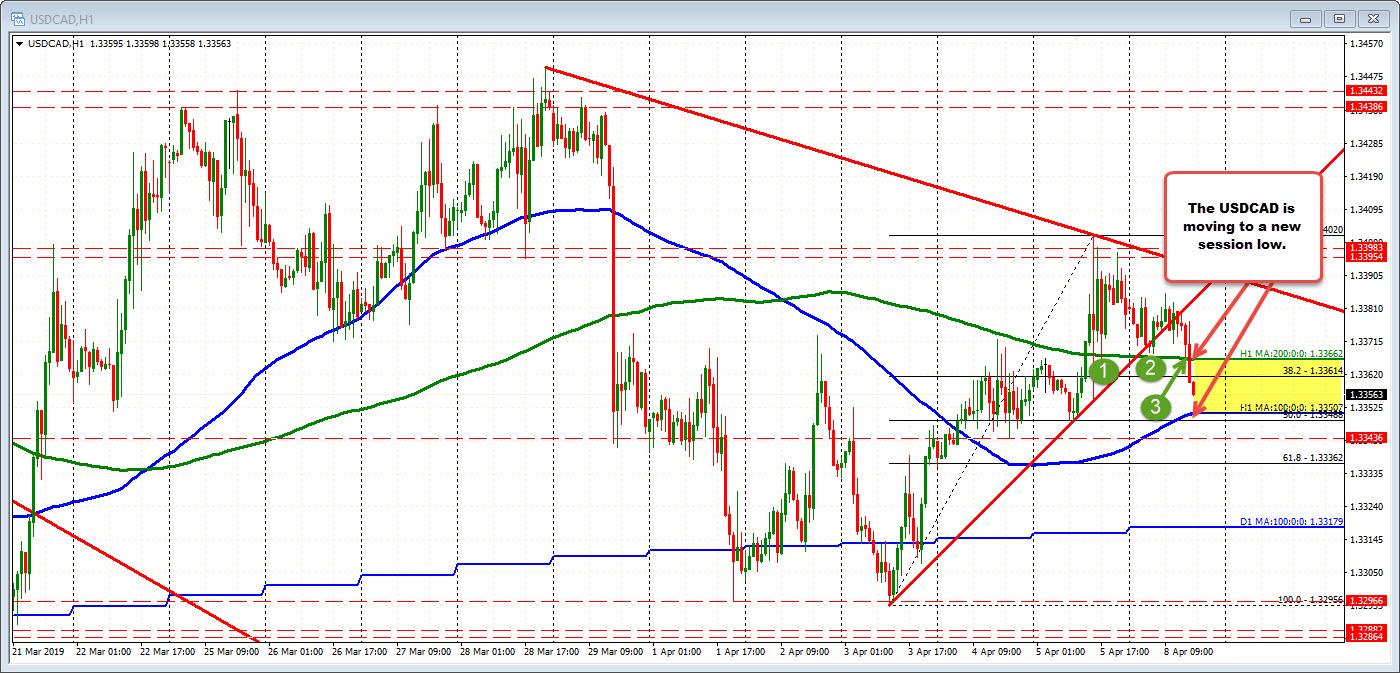

The 100 hour MA (blue line) is at 1.33507 and is the next target. The 50% is at 1.33488 and is another target to get through.

The index gets rejected by the 200-day moving average (blue line) as stocks retreated following gains seen earlier in the Asian morning. Risk sentiment is looking a bit jittery as markets hit the reset button after a more solid performance in Wall Street last Friday.