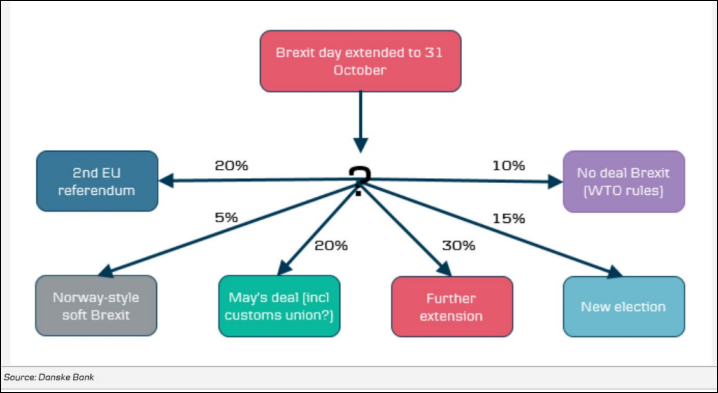

Danske Bank says a further extension is likely but it’s hard to back any one scenario to be a winner given current circumstances

h/t @ RANSquawk for the picture

h/t @ RANSquawk for the picture

And I certainly don’t disagree with Danske on that front. As it stands, there just isn’t a clear solution to break the Brexit impasse and there isn’t any clear way forward as long as May remains prime minister.

For the moment, UK lawmakers will be set for a break in conjunction with Easter next week from 16 April to 23 April so I would expect any steps forward in the Brexit saga to only come about after that.

The real issue with European leaders allowing an extension to Halloween Day is that it just solidifies the notion that all parties are wanting to avoid a no-deal and that they will extend this for as long as it takes to find a majority on something else. And that means another possible extension if we’re still stuck down this same road in six months’ time.

In the mean time, May is continuing to pursue cross-party talks but with Labour unlikely to move their red lines, she either has to cave in and lean towards a customs union or try and work on her original deal again for a third time.

The latter option is likely to draw heavier scrutiny this time around as it was dead on arrival already in the past two attempts, which means if talks with Labour fail, we could be seeing the end of May’s reign as prime minister.

In the bigger picture, the problem with rolling extensions is that eventually this is going to take a toll on the UK economy in a really, really expensive way. That’s when lawmakers will have to question “where do we draw the line?”. I reckon that is where potentially a second referendum and calls to revoke Article 50 altogether will come into play.

Otherwise, the UK risks economic suicide if it continues to play this game of limbo with no clear way to successfully make it to the other side.

h/t @ RANSquawk for the picture

h/t @ RANSquawk for the picture

Winners are grinners.

Winners are grinners.