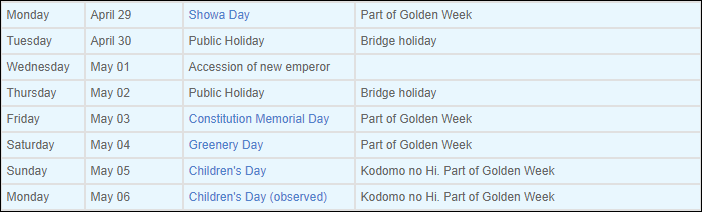

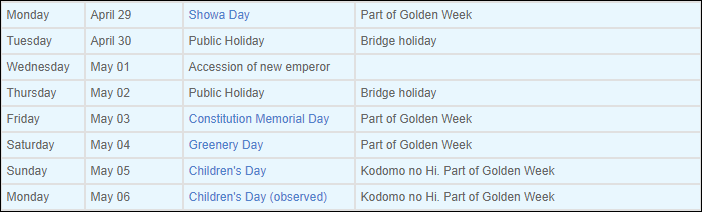

apanese markets will be set for a brief hiatus from next week onwards

The Colombo Stock Exchange will not open at its usual time on Monday following a series of bombings in Sri Lanka on Sunday that killed more than 200 people.

Sri Lanka was placed under a nationwide curfew on Sunday after bombs killed around 207 people at churches and hotels on Easter Sunday in the most lethal violence since the end of the country’s civil war in 2009. Ruwan Wijewardene, the defence minister, said 13 people had been detained in connection with the blasts.

The exchange said that following a consultation with the Securities and Exchange Commission of Sri Lanka in the wake of the attacks and a curfew imposed on the country that the market would not open on Monday for the safety and security of market participants.

“The SEC in consultation with the CSE will perform an ongoing assessment of the conditions necessary for an orderly conduct of the market, and will issue further communications as appropriate,” the statement said.