1. A good trade is taken with complete confidence, and follows your trading method. A bad trade is taken on an opinion.

2. A good trade is taken with a disciplined entry and position size. A bad trade is taken to win back losses the market owes you.

3. A good trade is taken when your entry parameters line up. A bad trade is taken out of fear of missing a move.

4. A good trade is taken to be profitable in the context of your trading plan. A bad trade is taken out of greed.

5. A good trade is taken according to your trading plan. A bad trade is taken to inflate the ego.

6. A good trade is taken without regret or internal conflict. A bad trade is taken when a trader is double-minded.

Archives of “April 26, 2019” day

rssEuropean equity close: German leads the way in a mixed week

Closing changes for the main European bourses:

- German DAX +0.32%

- French CAC +0.16%

- Spain IBEX -0.18%

- UK FTSE 100 -0.12%

- Italy MIB +0.08%

- German DAX +1.3%

- French CAC flat

- Spain IBEX -0.5%

- UK FTSE 100 -0.6%

- Italy MIB -1.2%

Here is a look at the DAX as the recovery continues:

Life lessons from Buffett and Munger — pure gold

An oldie! This ad is from a newspaper in 1953

Gold moves higher as dollar weakens

Up $8 on the day

It’s the moment of reckoning for Tesla shares

Shares break major support

Trump says he called OPEC and told them to bring prices down

Did he call Iran?

Chinese president Xi reportedly could travel to US to sign trade deal as early as June

SCMP reports, citing sources familiar with the matter

20 One liners from Market Wizards

They focus on what really matters in trading success.

They focus on what really matters in trading success.

They have developed a trading method that fits their own personality.

They trade with an edge.

The harder they work at trading the luckier they get.

They do the homework to develop a methodology through researching ideas.

The principles they use in their trading models are simple.

They have mental and emotional control is key while winning or losing.

They manage the risk to avoid failure and pain.

They have the discipline to follow their trading plan.

Market wizards have confidence and independence in themselves as traders

They are good losers. (Cutting losses when proven wrong and even reversing the direction of their trades when the price action dictates it).

They are patient with winning trades and impatient with losing trades.

The fully understand the right way to position size for their goals of returns and draw downs based on their risk/reward and winning percentage.

Market wizards understand comfortable trades are usually losing trades while the more uncomfortable trades are usually the winners.

Emotions are dangerous masters to the trader, they know how to manage their own emotions.

Market wizards evolve as a trader to avoid eventually failing in a method that has lost its edge over time.

It is not the news but how the market reacts to that news is what they watch for.

The best trader are always learning through their own mistakes.

Passion for trading was the fuel for their eventual success.

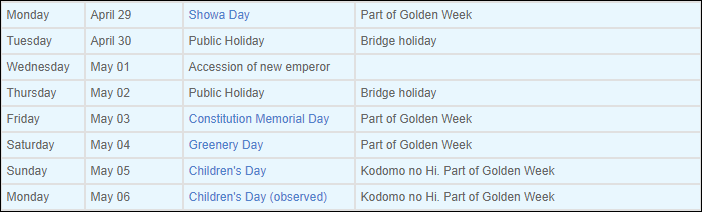

Reminder: Japanese markets set for a 10-day break after today

Normal service will only resume back on 7 May